Blank Affidavit of Gift Template for Washington State

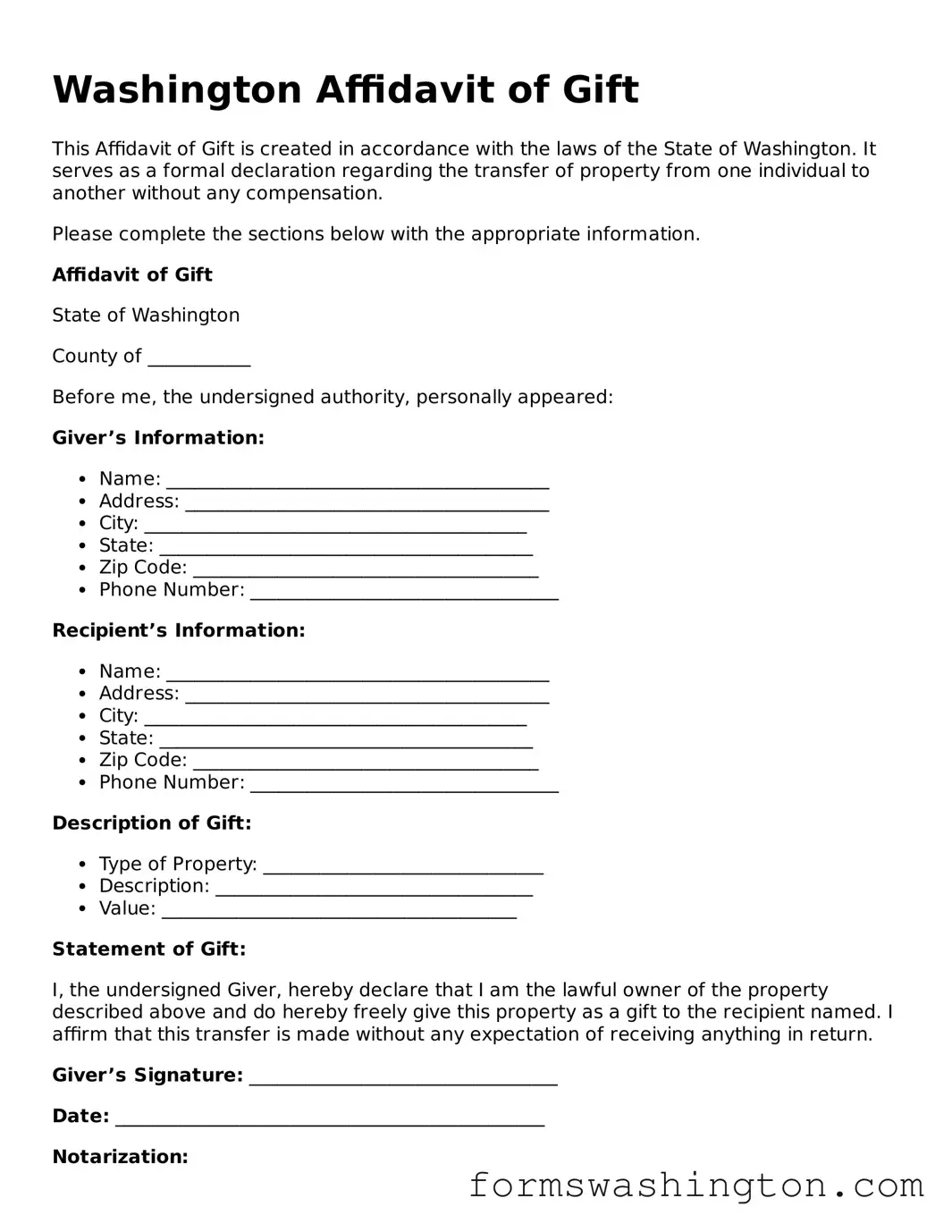

The Washington Affidavit of Gift form is a crucial document for individuals looking to transfer ownership of personal property without the complexities of a formal sale. This form serves as a declaration that the property has been given as a gift, ensuring that both the giver and the recipient have a clear understanding of the transaction. It typically includes essential details such as the names and addresses of both parties, a description of the property being gifted, and the date of the transfer. By using this form, individuals can avoid potential disputes regarding ownership in the future, as it provides a written record of the gift. Additionally, the Affidavit of Gift may be required for certain types of property transfers, such as vehicles or real estate, making it a necessary tool in estate planning and asset management. Understanding the implications of this document is vital for anyone involved in a gift transaction, as it helps to formalize the process and protect the interests of all parties involved.

Documents used along the form

The Washington Affidavit of Gift form is an important document used to transfer ownership of property or assets as a gift. However, several other forms and documents may accompany it to ensure a smooth and legally sound process. Below is a list of commonly used documents that often go hand-in-hand with the Affidavit of Gift.

- Gift Tax Return (IRS Form 709): This form is required if the value of the gift exceeds the annual exclusion limit. It helps report the gift to the IRS for tax purposes.

- Deed of Gift: This document formally transfers ownership of real property from the donor to the recipient. It outlines the specifics of the property being gifted.

- Bill of Sale: Used for transferring ownership of personal property, such as vehicles or equipment. It serves as proof of the transaction between the giver and the receiver.

- Florida Trailer Bill of Sale: This form is essential for transferring ownership of a trailer in Florida and serves as proof of the transaction. For more details, visit TopTemplates.info.

- Power of Attorney: This document allows someone to act on behalf of another person in legal matters. It can be helpful if the donor cannot be present to sign documents.

- Trust Agreement: If the gift is placed in a trust, this document outlines the terms and conditions of the trust, including how the assets should be managed and distributed.

- Property Transfer Form: This form is used to officially record the transfer of property ownership with the local government or relevant authority.

- Beneficiary Designation Form: This form allows individuals to designate who will receive certain assets, such as life insurance or retirement accounts, upon their death.

- Letter of Intent: This document expresses the donor's wishes regarding the gift and can provide additional context to the recipient about the intention behind the gift.

- Tax Identification Number (TIN) Application: If the gift involves a business entity, obtaining a TIN may be necessary for tax reporting purposes.

- Affidavit of Identity: This document can be used to verify the identity of the parties involved in the gift transaction, ensuring that all information is accurate and legitimate.

Using the appropriate forms and documents alongside the Washington Affidavit of Gift helps ensure that the gifting process is clear and legally binding. It is always a good idea to consult with a legal professional to ensure compliance with all relevant laws and regulations.

Misconceptions

The Washington Affidavit of Gift form is often misunderstood. Below are five common misconceptions about this form, along with clarifications for each one.

-

It is only used for real estate transactions.

Many people believe the Affidavit of Gift is limited to real estate. In reality, it can apply to various types of gifts, including personal property, vehicles, and other assets.

-

It requires a notary public to be valid.

Some individuals think that notarization is mandatory for the Affidavit of Gift. While having it notarized can add an extra layer of authenticity, it is not a strict requirement for the form to be legally binding.

-

It is only applicable between family members.

There is a misconception that the Affidavit of Gift is exclusively for gifts among family. However, this form can be used for any two parties, regardless of their relationship, as long as the gift is given voluntarily.

-

Filing the form is mandatory for all gifts.

Some people assume that they must file this form for every gift they make. In truth, the Affidavit of Gift is not required for small gifts or informal transfers, though it can help clarify the intent behind larger gifts.

-

It eliminates all tax implications.

Many believe that using the Affidavit of Gift means there are no tax consequences. While the form can help document the gift, it does not automatically exempt the giver or recipient from potential gift tax obligations.

Understanding these misconceptions can help individuals navigate the gifting process more effectively and ensure they are making informed decisions.

Check out Some Other Templates for Washington

Washington Prenuptial Contract - Shows accountability and responsibility regarding shared financial obligations.

In order to facilitate a transparent and secure vehicle transaction in Texas, it is important to utilize the Texas Vehicle Purchase Agreement. This form is essential in clarifying the sale's terms between the buyer and seller, detailing specifics such as the vehicle's identification details, purchase price, and the obligations of both parties. To learn more about this vital document, you can visit topformsonline.com/texas-vehicle-purchase-agreement/.

Power of Attorney Form Washington State - This form can be instrumental in estate planning.

Washington State Polst Form - Helps to clarify a patient’s stance on aggressive treatment measures.

Dos and Don'ts

When filling out the Washington Affidavit of Gift form, it's important to ensure accuracy and compliance. Here are some key dos and don'ts to keep in mind:

- Do provide complete and accurate information. Double-check all entries to avoid delays.

- Do sign and date the form. An unsigned affidavit may not be accepted.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Do consult with a legal expert if you're unsure about any part of the process. Getting it right the first time is crucial.

- Don't leave any required fields blank. Incomplete forms can lead to rejection.

- Don't use white-out or other correction methods. If you make a mistake, it's better to start over.

- Don't submit the form without verifying the recipient's information. Errors can complicate the gift transfer.

- Don't ignore deadlines. Ensure you submit the affidavit in a timely manner to avoid issues.