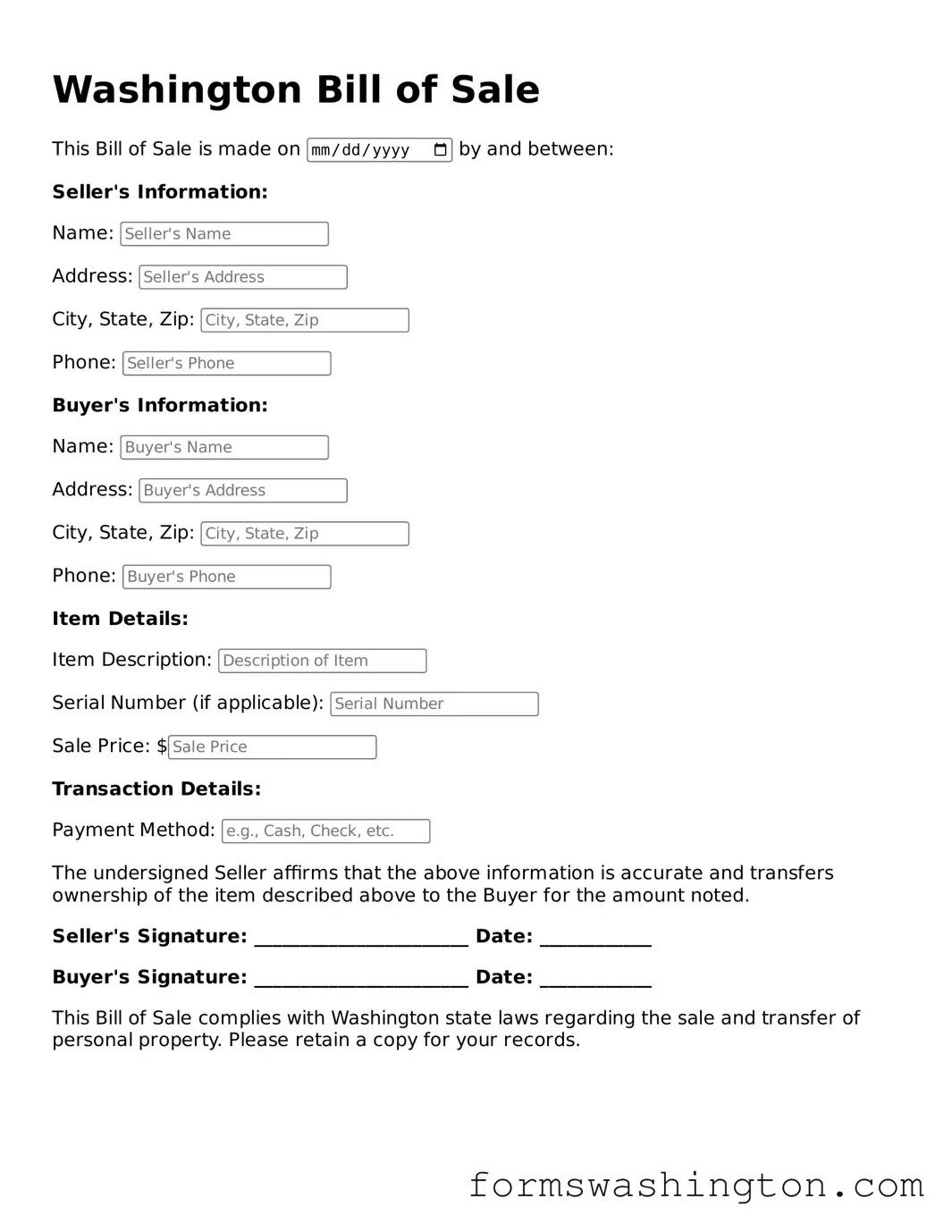

Blank Bill of Sale Template for Washington State

The Washington Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property, including vehicles, boats, and other tangible items. This form not only provides a legal record of the transaction but also protects both the buyer and the seller by outlining the terms of the sale. Essential details such as the names and addresses of the parties involved, a description of the item being sold, and the sale price must be clearly stated. Additionally, the form may require signatures from both parties to validate the agreement. In Washington, having a properly completed Bill of Sale can facilitate the registration process with the Department of Licensing, making it an indispensable tool for anyone involved in buying or selling personal property. Understanding the components and importance of this document can help ensure a smooth transaction and provide peace of mind for all parties involved.

Documents used along the form

The Washington Bill of Sale form serves as a crucial document in the transfer of ownership for various types of property, including vehicles, boats, and personal items. However, several other forms and documents often accompany it to ensure a smooth transaction and proper record-keeping. Below is a list of these important documents.

- Title Transfer Form: This document is essential when selling or transferring ownership of a vehicle. It officially changes the title from the seller to the buyer, ensuring that the new owner is recognized by the state.

- Odometer Disclosure Statement: Required for vehicle sales, this form records the vehicle's mileage at the time of sale. It helps prevent fraud and protects both parties by providing accurate information about the vehicle's condition.

- Vehicle Registration Application: After acquiring a vehicle, the new owner must complete this form to register the vehicle in their name. It typically includes details such as the vehicle identification number (VIN) and the buyer's information.

- Sales Tax Form: This document is used to report and pay any applicable sales tax on the transaction. It ensures compliance with state tax laws and may be required for the buyer to complete the registration process.

In summary, while the Washington Bill of Sale form is a key component in property transactions, it works best in conjunction with other documents. Each of these forms plays a vital role in ensuring a clear and legal transfer of ownership, protecting the interests of both the buyer and the seller.

Misconceptions

Understanding the Washington Bill of Sale form is essential for anyone involved in the sale or transfer of personal property. However, there are several misconceptions that can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- It is only for vehicle sales. Many people believe that a Bill of Sale is only required for vehicle transactions. In reality, it can be used for various types of personal property, including boats, trailers, and even furniture.

- A Bill of Sale is not legally required. While a Bill of Sale is not always legally required for every transaction, it is highly recommended. It serves as proof of the transaction and can protect both the buyer and seller in case of disputes.

- All Bills of Sale are the same. There is a misconception that all Bill of Sale forms are interchangeable. However, each state may have specific requirements, and the form should be tailored to meet those needs.

- It does not need to be notarized. Some individuals think that a Bill of Sale does not require notarization. While notarization is not mandatory in Washington, having it notarized can provide additional legal protection.

- It is only necessary for sales between strangers. People often believe that a Bill of Sale is only necessary when dealing with unfamiliar parties. In fact, even transactions between friends or family members can benefit from having a written record.

- Once signed, it cannot be changed. Some may think that a Bill of Sale is set in stone once signed. Amendments can be made, but both parties must agree to the changes and initial the document accordingly.

- It is only for used items. There is a common belief that a Bill of Sale is only applicable for used goods. New items can also be sold with a Bill of Sale, providing a clear record of the transaction.

- It is unnecessary if there is a receipt. While a receipt can serve as proof of purchase, it does not provide the same level of detail as a Bill of Sale. A Bill of Sale typically includes more comprehensive information about the transaction.

- It is not important for tax purposes. Some individuals may overlook the importance of a Bill of Sale for tax documentation. This form can be useful when reporting income or capital gains on tax returns.

- Only the seller needs a copy. A common misconception is that only the seller should keep a copy of the Bill of Sale. Both the buyer and seller should retain a copy for their records to ensure clarity in the transaction.

Addressing these misconceptions can help individuals navigate the process of creating and using a Washington Bill of Sale form more effectively. It is always best to approach such transactions with clarity and proper documentation.

Check out Some Other Templates for Washington

2024 Labor Laws - The document should be drafted clearly to avoid ambiguity regarding what constitutes competition.

Power of Attorney Wa - It is also advisable to inform the child (if age-appropriate) about who will be caring for them and why.

Bill of Sale Washington State - The document can help confirm that both parties agree to the terms of the sale.

Dos and Don'ts

When filling out the Washington Bill of Sale form, it is essential to approach the task with care. This document serves as a legal record of the transaction between a buyer and a seller. To ensure that the process goes smoothly, here are some important dos and don’ts to consider:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do clearly describe the item being sold, including its make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Do specify the sale price and the method of payment to avoid any misunderstandings later.

- Do ensure both parties sign and date the document to validate the transaction.

- Don't leave any fields blank; incomplete information can lead to complications.

- Don't use vague descriptions for the item. Be specific to prevent disputes.

- Don't forget to keep a copy of the signed Bill of Sale for your records.

By following these guidelines, you can create a clear and effective Bill of Sale that protects both parties involved in the transaction.