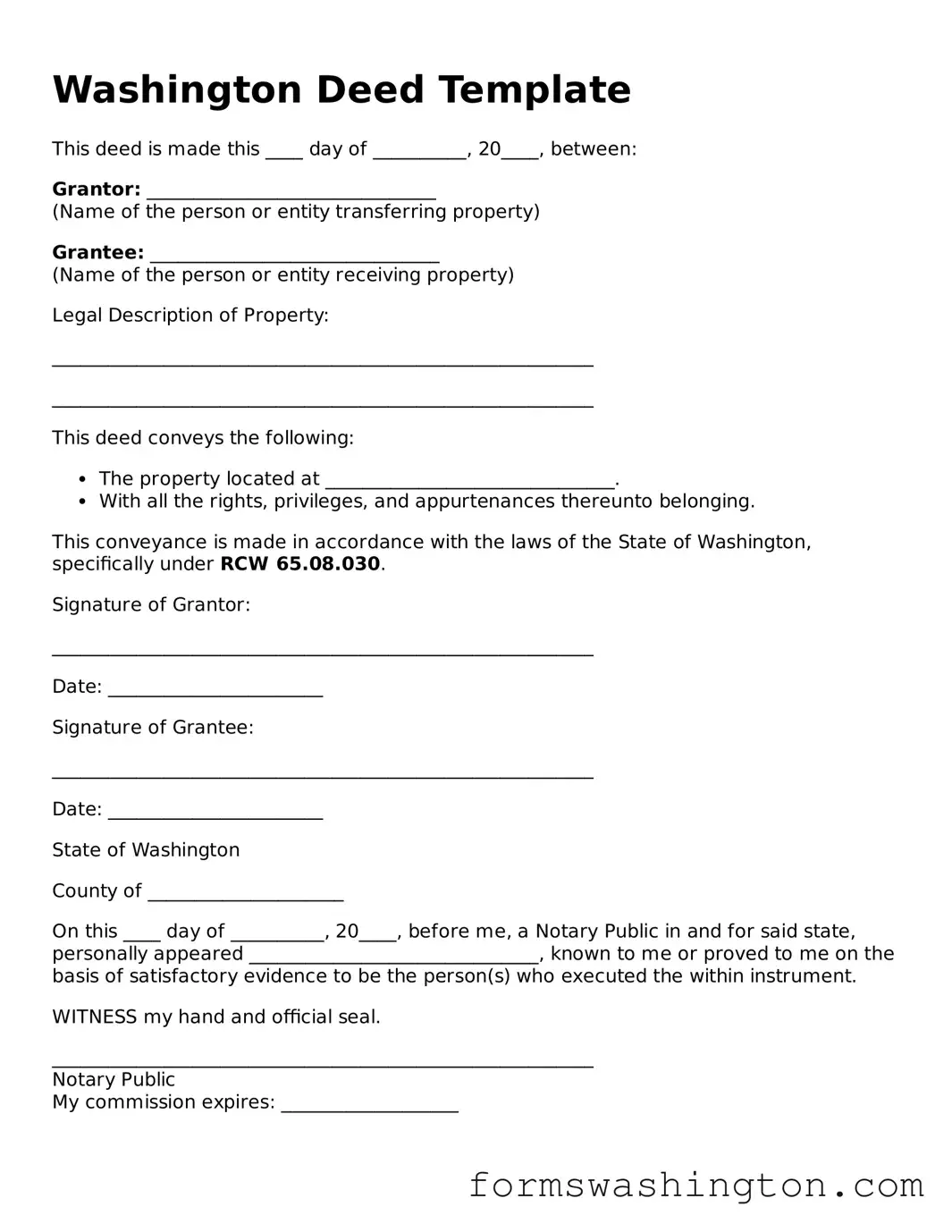

Blank Deed Template for Washington State

The Washington Deed form serves as a crucial document in the transfer of real estate ownership within the state of Washington. This form outlines the details of the transaction, including the names of the parties involved, the legal description of the property, and the terms of the transfer. Essential information such as the date of execution and any applicable consideration must also be included. The form can be used for various types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes in property transfer. Proper execution and recording of the deed are necessary to ensure the legality and enforceability of the transfer. Additionally, the form may require notarization to verify the identities of the parties involved, which adds a layer of protection against fraud. Understanding the components and requirements of the Washington Deed form is vital for anyone involved in real estate transactions in the state.

Documents used along the form

When dealing with property transactions in Washington, various forms and documents are essential alongside the Washington Deed form. Each of these documents plays a crucial role in ensuring a smooth transfer of property ownership and compliance with state regulations. Below is a list of commonly used documents that may accompany the Washington Deed form.

- Property Title Report: This document provides a comprehensive overview of the property's title history, including any liens, encumbrances, or claims against the property. It ensures that the seller has clear ownership to transfer.

- Affidavit of Identity: This sworn statement verifies the identity of the parties involved in the transaction. It helps prevent fraud and ensures that the correct individuals are executing the deed.

- Bill of Sale: If personal property is included in the sale, a Bill of Sale transfers ownership of these items from the seller to the buyer. It outlines what items are being sold and their condition.

- Closing Disclosure: This document outlines the final terms of the mortgage loan, including all closing costs. It is provided to the buyer at least three days before closing to ensure transparency.

- Escrow Agreement: This agreement details the terms under which an escrow agent will hold funds or documents until the transaction is completed. It protects both parties during the closing process.

- Property Transfer Affidavit: Required by the county assessor, this document provides information about the property transfer for tax assessment purposes. It ensures accurate property records are maintained.

- Florida Sales Tax Form: As businesses operating in Florida must manage their sales tax obligations, it is essential to utilize the read the document to ensure compliance with reporting and remittance requirements.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community. They are crucial for the buyer to review before closing.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the title. It is essential for safeguarding the investment in the property.

- Deed of Trust: Often used in conjunction with a mortgage, this document secures the loan by placing a lien on the property. It outlines the terms of the loan and the rights of the lender.

Understanding these documents is vital for anyone involved in a property transaction in Washington. Each plays a significant role in ensuring that the transfer of ownership is legally sound and that all parties are protected throughout the process. Always consult with a qualified professional to ensure that all necessary documents are correctly completed and submitted.

Misconceptions

When it comes to the Washington Deed form, several misconceptions can lead to confusion for those looking to transfer property. Understanding these myths can help you navigate the process more smoothly. Here are five common misconceptions:

-

All deeds are the same. Many people believe that all property deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own implications regarding ownership rights and guarantees.

-

You don’t need a lawyer to complete a deed. While it is possible to fill out a deed without legal assistance, having a lawyer can provide valuable guidance. They can help ensure that the deed is filled out correctly and that all legal requirements are met.

-

Once a deed is signed, it cannot be changed. Some people think that signing a deed is the final step and that it cannot be altered. However, deeds can be amended or revoked under certain circumstances, depending on the type of deed and local laws.

-

Recording a deed is optional. Many believe that recording a deed with the county is not necessary. In fact, recording is crucial as it provides public notice of the property transfer and protects the buyer's ownership rights.

-

Deeds are only for selling property. While deeds are commonly associated with the sale of property, they can also be used for other purposes, such as transferring property as a gift or as part of an estate plan.

By addressing these misconceptions, you can approach the process of using a Washington Deed form with greater confidence and clarity.

Check out Some Other Templates for Washington

Washington State Divorce Papers - Can include confidentiality clauses regarding personal matters.

To create a thorough and effective Employee Handbook, employers can utilize resources that provide templates and guidance, such as those available at smarttemplates.net. These tools can assist in crafting a document that clearly conveys the company's policies and fosters a better understanding of employee expectations.

Washington State Living Will Forms Free - A useful resource for managing chronic conditions and unexpected health crises.

How to File for Legal Separation in Washington State - Serves as a framework for dividing assets and debts post-separation.

Dos and Don'ts

When filling out the Washington Deed form, attention to detail is crucial. Here are ten important tips to consider:

- Do ensure that all names are spelled correctly. Any errors can lead to complications later.

- Don’t leave any required fields blank. Incomplete forms may be rejected.

- Do provide accurate property descriptions. This helps avoid disputes over boundaries.

- Don’t forget to sign the form. An unsigned deed is not valid.

- Do have the deed notarized. This adds an extra layer of authenticity.

- Don’t use white-out or any correction fluid. Corrections should be made by crossing out and initialing.

- Do keep a copy of the completed form for your records. This can be useful in the future.

- Don’t forget to check for any local recording requirements. Different counties may have specific rules.

- Do consult with a legal expert if you have questions. It’s better to ask than to make a mistake.

- Don’t rush through the process. Take your time to ensure everything is filled out correctly.