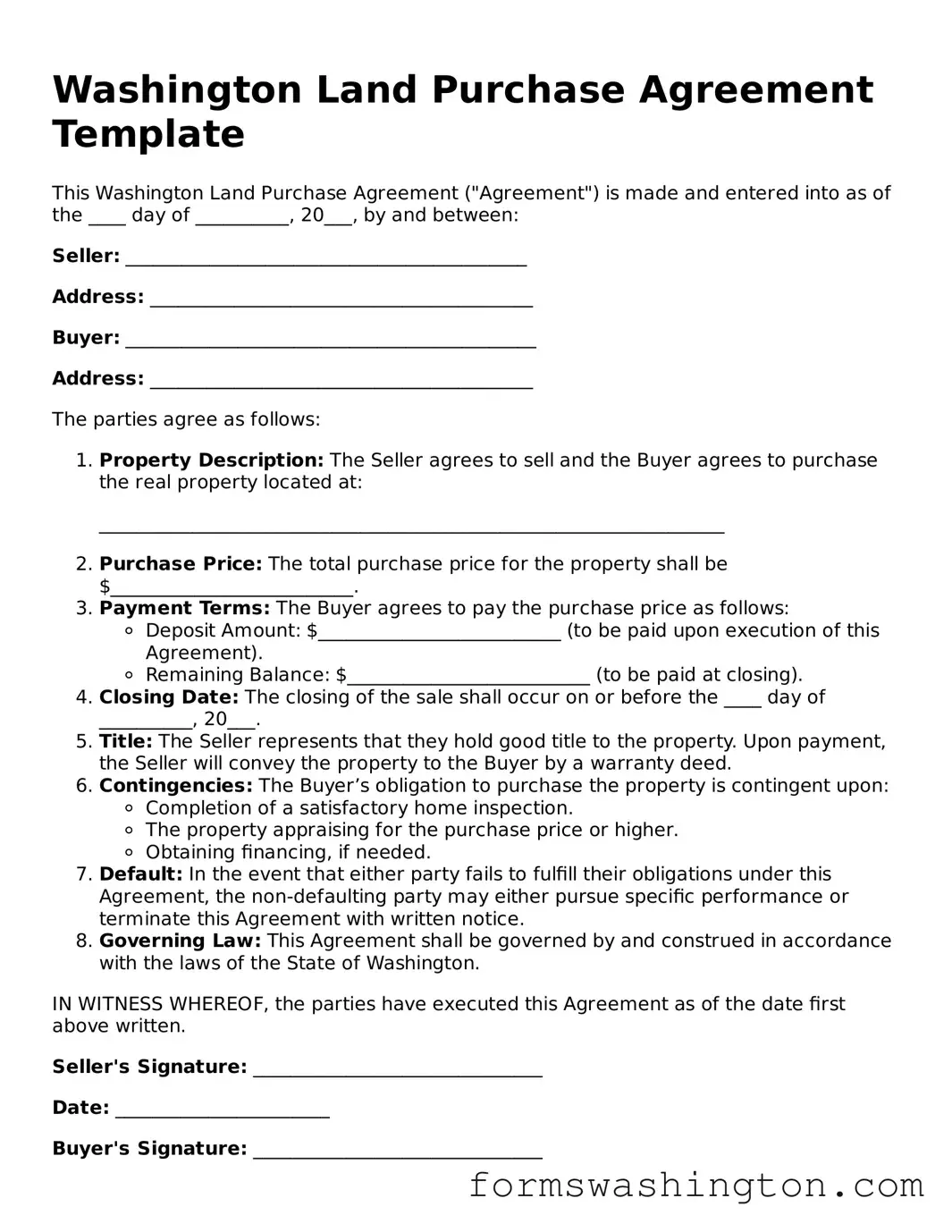

Blank Land Purchase Agreement Template for Washington State

The Washington Land Purchase Agreement form serves as a crucial document in real estate transactions, outlining the terms and conditions under which property is bought and sold in the state of Washington. This form typically includes essential details such as the identities of the buyer and seller, a clear description of the property being purchased, and the agreed-upon purchase price. Additionally, it specifies the closing date and any contingencies that must be met before the sale can be finalized, such as inspections or financing approvals. The agreement also addresses the responsibilities of both parties, including disclosures related to property conditions and any potential liens. By providing a structured framework for the transaction, the Washington Land Purchase Agreement helps to protect the interests of both buyers and sellers, ensuring clarity and legal compliance throughout the process. Understanding this form is vital for anyone involved in real estate in Washington, as it lays the foundation for a successful property transfer and helps to mitigate potential disputes that may arise during or after the transaction.

Documents used along the form

When engaging in real estate transactions in Washington, several forms and documents may accompany the Land Purchase Agreement. Each of these documents serves a specific purpose in ensuring that the transaction is clear, legal, and binding. Below is a list of commonly used forms and documents.

- Purchase and Sale Agreement: This document outlines the terms of the sale, including the price, payment terms, and closing date. It serves as a formal contract between the buyer and seller.

- Durable Power of Attorney: In certain situations, having a Durable Power of Attorney can be essential, particularly if you anticipate needing someone to manage your affairs. More information can be found at https://smarttemplates.net/.

- Earnest Money Receipt: This receipt acknowledges the buyer's deposit, showing their commitment to the purchase. It details the amount and conditions under which the deposit will be held.

- Title Report: A title report provides information about the ownership of the property, including any liens or encumbrances. This ensures that the seller has the right to sell the property.

- Disclosure Statement: Sellers are often required to provide a disclosure statement that details any known issues with the property. This protects buyers by informing them of potential problems.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It outlines all costs, fees, and credits associated with the sale.

- Deed: The deed transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be legally effective.

- Property Inspection Report: This report details the condition of the property after an inspection. It can reveal necessary repairs and help buyers make informed decisions.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Financing Documents: If the buyer is obtaining a mortgage, these documents include loan applications and agreements that detail the terms of the financing.

- Affidavit of Title: This document is a sworn statement from the seller affirming their ownership of the property and the absence of any undisclosed liens or claims.

Each of these documents plays a crucial role in the real estate transaction process. Understanding their purpose can help ensure a smoother experience when purchasing or selling property in Washington.

Misconceptions

When it comes to the Washington Land Purchase Agreement form, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It is only for residential properties. Many believe that the Land Purchase Agreement is exclusively for homes. In reality, it can be used for various types of real estate, including commercial and vacant land.

- It must be notarized to be valid. Some people think that notarization is a requirement for the agreement to be enforceable. While notarization can add an extra layer of authenticity, it is not a legal necessity in Washington.

- Verbal agreements are sufficient. There is a common belief that a verbal agreement can replace a written one. However, having a written contract is essential for clarity and legal protection.

- All terms are negotiable. While many terms can be negotiated, some aspects, such as state laws and regulations, must be adhered to and cannot be changed.

- The seller is always responsible for repairs. A misconception exists that the seller must handle all repairs before the sale. However, the agreement can specify that the buyer accepts the property "as is."

- It is the same as a lease agreement. Some individuals confuse the Land Purchase Agreement with a lease. A purchase agreement is for buying property, while a lease is for renting it.

- Once signed, it cannot be changed. Many think that after signing, the agreement is set in stone. In fact, amendments can be made if both parties agree to the changes.

- It does not need to include contingencies. Some believe that contingencies are optional. However, including contingencies, like financing or inspection clauses, can protect both parties.

- It is a simple form with no legal implications. There is a misconception that the form is straightforward and lacks legal weight. In truth, this agreement is a legally binding document that outlines significant obligations.

Understanding these misconceptions can help individuals navigate the process of buying or selling land in Washington more effectively.

Check out Some Other Templates for Washington

Employment Verification California - This verification is often required for mortgage applications.

For parents seeking to comply with educational regulations, understanding the significance of the Homeschool Letter of Intent form is vital for a successful homeschooling journey. You can find more information on this important documentation by exploring the Homeschool Letter of Intent requirements.

How to Transfer Ownership of a Tractor - Regularly used by farmers and equipment dealers alike.

Dos and Don'ts

When filling out the Washington Land Purchase Agreement form, it’s essential to approach the task with care and attention. Here are nine important things to keep in mind:

- Do read the entire form thoroughly before starting. Understanding each section will help prevent mistakes.

- Don't rush through the process. Taking your time can save you from costly errors.

- Do provide accurate information. Double-check names, addresses, and legal descriptions of the property.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejection.

- Do consult with a real estate professional if you have questions. Their expertise can be invaluable.

- Don't ignore the importance of signatures. Ensure that all necessary parties sign the agreement.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't forget to include any necessary attachments or supporting documents. These may be crucial for the agreement.

- Do review the agreement with all parties involved before submission. Everyone should understand the terms and conditions.