Blank Last Will and Testament Template for Washington State

Creating a Last Will and Testament is a vital step in ensuring that your wishes are honored after your passing. In Washington State, this legal document serves as a formal declaration of how your assets and property should be distributed among your heirs. It provides you with the opportunity to appoint a personal representative, who will be responsible for managing your estate and ensuring that your instructions are followed. Additionally, the form allows you to designate guardians for any minor children, ensuring their care and well-being in the event of your death. By clearly outlining your intentions, the Washington Last Will and Testament helps to minimize confusion and disputes among family members, offering peace of mind during a difficult time. Understanding the essential components of this form, including the requirements for validity and execution, is crucial for anyone looking to create a comprehensive estate plan that reflects their personal values and desires.

Documents used along the form

When preparing a Last Will and Testament in Washington, there are several other important documents that can complement this essential legal instrument. Each of these documents serves a unique purpose and can help ensure that your wishes are honored after your passing. Below is a brief overview of five commonly used forms and documents that often accompany a Last Will and Testament.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. It remains effective even if you are unable to communicate your wishes.

- Health Care Directive: Also known as a living will, this document specifies your preferences for medical treatment in situations where you cannot express your wishes. It can guide healthcare providers and family members in making decisions that align with your values.

- Revocable Living Trust: This legal arrangement allows you to transfer your assets into a trust during your lifetime. It can help avoid probate and provide for the management of your assets if you become unable to do so yourself.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to designate beneficiaries. These designations can bypass the will and ensure that specific assets are distributed directly to the chosen individuals upon your death.

- Pet Trust: If you have pets, a pet trust can be established to ensure their care after your passing. This document outlines how funds should be used for their care and designates a caregiver to look after them.

Incorporating these documents into your estate planning can provide clarity and peace of mind. By ensuring that all aspects of your wishes are documented, you can help your loved ones navigate the complexities of your estate more smoothly and with less stress.

Misconceptions

Understanding the Washington Last Will and Testament form can be challenging, especially with the many misconceptions that surround it. Here are eight common misunderstandings, along with clarifications to help you navigate the process more effectively.

- A will must be notarized to be valid. In Washington, a will does not need to be notarized to be legally valid. However, having a notary can simplify the probate process.

- Only wealthy individuals need a will. This is not true. Anyone with assets, regardless of their value, can benefit from having a will to ensure their wishes are honored after death.

- A will can be written on any piece of paper. While technically possible, it is advisable to use a formal format. This helps ensure clarity and reduces the likelihood of disputes.

- Once a will is created, it cannot be changed. This is a misconception. A will can be amended or revoked at any time, as long as the person creating it is of sound mind.

- Wills are only for distribution of property. Wills can also address guardianship for minor children and can specify funeral arrangements, making them versatile documents.

- All assets automatically go to the spouse. While many people assume this, it’s not always the case. A will can specify different beneficiaries, overriding default laws.

- Oral wills are valid in Washington. Washington does not recognize oral wills, also known as nuncupative wills. Written documentation is essential for legal validity.

- Having a will avoids probate. This is a common myth. A will does not eliminate probate; it merely provides instructions for how the probate process should unfold.

By understanding these misconceptions, individuals can make informed decisions about their estate planning and ensure their wishes are clearly communicated and legally upheld.

Check out Some Other Templates for Washington

Small Estate Affidavit Washington - The Small Estate Affidavit is a practical solution for families seeking to honor the deceased's wishes efficiently.

Cease to Desist - Offers a chance for the recipient to correct actions.

Dos and Don'ts

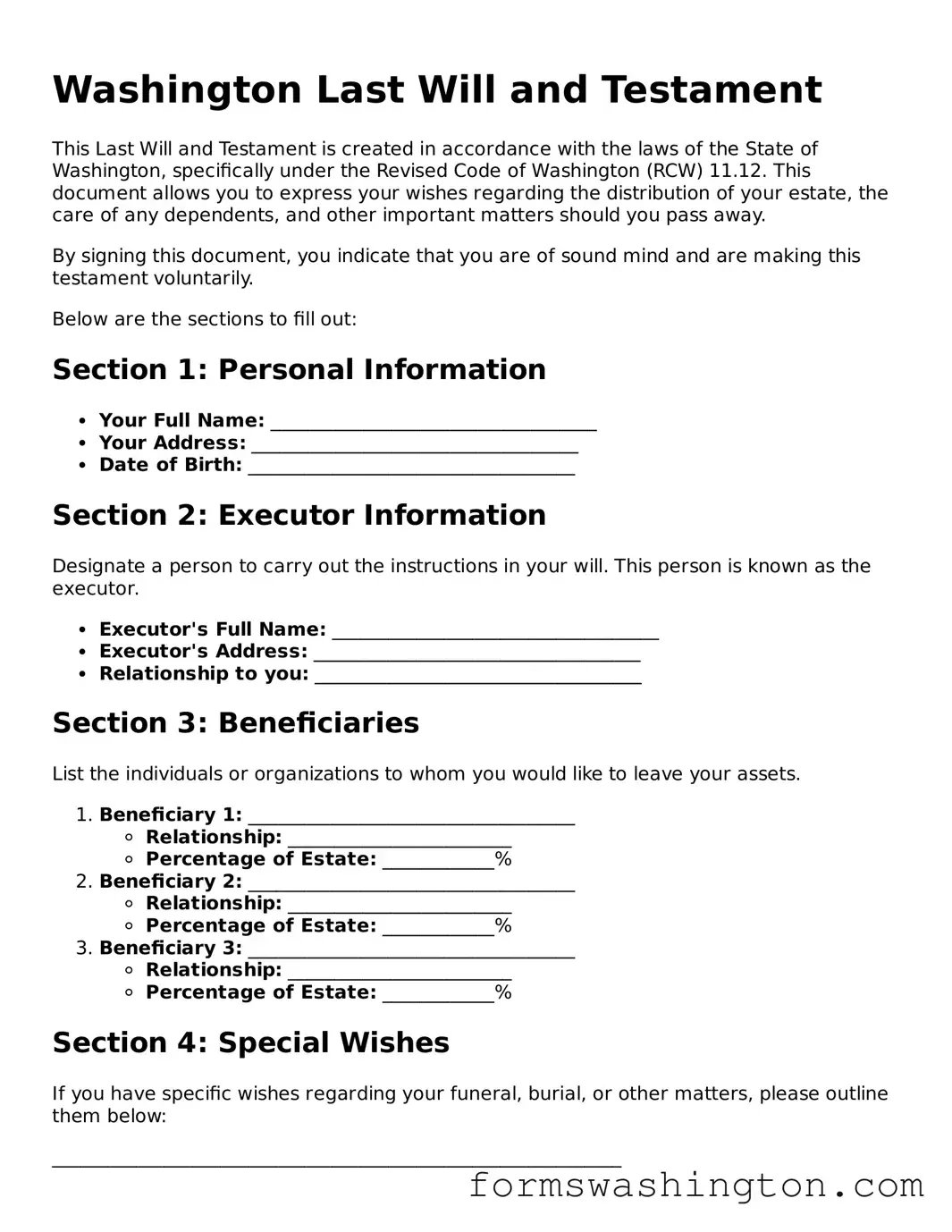

When filling out the Washington Last Will and Testament form, it’s important to follow certain guidelines to ensure your wishes are clearly expressed. Here’s a list of things you should and shouldn’t do:

- Do clearly state your full name and address at the beginning of the document.

- Don't use vague language that could lead to confusion about your intentions.

- Do designate an executor who will carry out your wishes.

- Don't forget to include a clause for guardianship if you have minor children.

- Do list your assets and specify how you want them distributed.

- Don't leave out any important assets that you want to address in your will.

- Do sign and date the will in the presence of at least two witnesses.

- Don't have witnesses who are beneficiaries of the will, as this can complicate matters.

- Do keep the original will in a safe place and inform your executor of its location.

- Don't make any changes to the will without following the proper legal procedures.