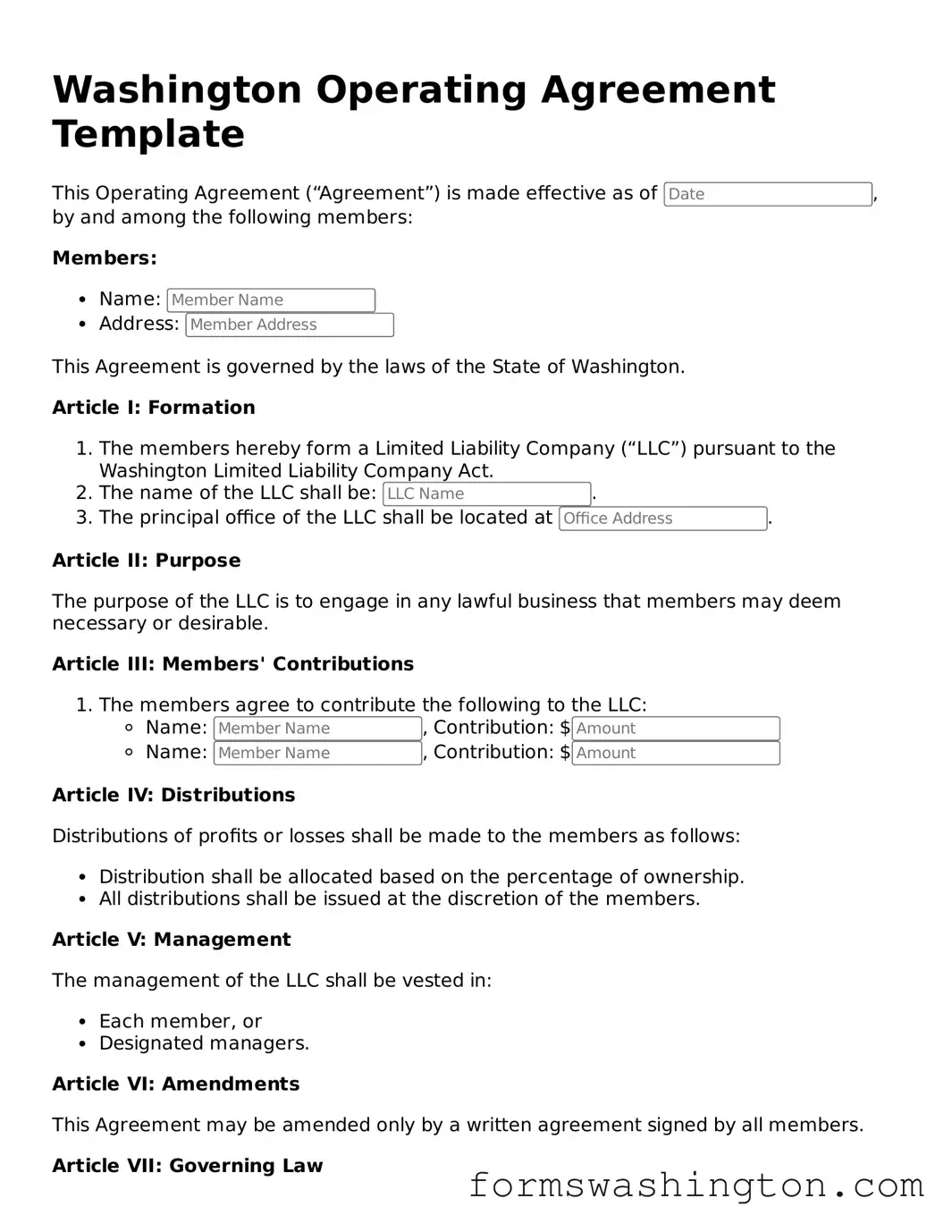

Blank Operating Agreement Template for Washington State

The Washington Operating Agreement form is a crucial document for any limited liability company (LLC) operating in the state of Washington. This form outlines the internal structure and operating procedures of the LLC, ensuring that all members are on the same page regarding their roles, responsibilities, and the management of the company. Key aspects include the distribution of profits and losses, voting rights, and the process for making important business decisions. Additionally, the agreement addresses how new members can join and the procedures for handling member exits or dissolutions. By clearly defining these elements, the Operating Agreement helps prevent disputes among members and provides a framework for the LLC's operations. Understanding the importance of this document can significantly impact the success and stability of a business venture in Washington.

Documents used along the form

When forming a limited liability company (LLC) in Washington, it's important to have several key documents prepared. These documents work together with the Operating Agreement to ensure that your LLC operates smoothly and in compliance with state laws. Below is a list of forms and documents that are often used alongside the Washington Operating Agreement.

- Articles of Organization: This document is filed with the Washington Secretary of State to officially create your LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Member Consent Form: This form is used to document the agreement among members regarding significant decisions, such as the admission of new members or changes in ownership. It ensures that all members are on the same page.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for managing the LLC. They can cover topics such as voting rights, meeting protocols, and roles of members.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include guidelines for decision-making, financial management, and member responsibilities.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can help clarify ownership percentages and rights associated with membership.

- Tax Registration Forms: Depending on your business activities, you may need to register for various state and federal taxes. This ensures that your LLC complies with tax obligations.

Having these documents prepared and organized can help you establish a solid foundation for your LLC. Each form plays a vital role in ensuring compliance and clarity among members, ultimately contributing to the success of your business.

Misconceptions

When it comes to the Washington Operating Agreement form, several misconceptions can lead to confusion for business owners and entrepreneurs. Understanding these misunderstandings is essential for effective business management and compliance. Here are five common misconceptions:

-

All businesses in Washington must file an Operating Agreement.

This is not true. While having an Operating Agreement is highly recommended for LLCs in Washington, it is not a legal requirement. However, without one, members may face challenges in managing the business and resolving disputes.

-

An Operating Agreement is the same as a business plan.

Many people confuse an Operating Agreement with a business plan. The two documents serve different purposes. An Operating Agreement outlines the internal workings and management structure of the LLC, while a business plan focuses on the company's goals, strategies, and market analysis.

-

Once created, the Operating Agreement cannot be changed.

This misconception is misleading. An Operating Agreement can be amended as needed, provided that all members agree to the changes. Flexibility is key in adapting to new circumstances or business needs.

-

Operating Agreements are only necessary for multi-member LLCs.

Even single-member LLCs can benefit from having an Operating Agreement. It provides clarity on ownership, management, and operational procedures, which can be particularly helpful for legal protection and tax purposes.

-

The state provides a standard Operating Agreement template that must be used.

While the state does not mandate a specific template, it does provide guidelines on what should be included in an Operating Agreement. Business owners have the freedom to create a document that suits their unique needs and circumstances.

By addressing these misconceptions, business owners can better navigate the complexities of forming and operating an LLC in Washington. Understanding the true nature of the Operating Agreement is vital for ensuring smooth operations and protecting the interests of all members involved.

Check out Some Other Templates for Washington

Washington State Divorce Papers - Details arrangements for retirement accounts and pensions.

Pdf Horse Bill of Sale Template - Creates a clear timeline for the sale transaction, protecting both parties.

Dos and Don'ts

When filling out the Washington Operating Agreement form, it’s essential to approach the task with care. Here’s a helpful list of things to do and avoid:

- Do read the instructions thoroughly before starting. Understanding the requirements can save you time and confusion.

- Do provide accurate information. Double-check names, addresses, and any other details to ensure correctness.

- Do consult with a legal professional if you have questions. Getting expert advice can clarify complex issues.

- Do ensure all members sign the agreement. This step is crucial for the document’s validity.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejections.

- Don't use vague language. Be specific in your descriptions to avoid misunderstandings later.

- Don't forget to date the agreement. This detail is important for legal purposes.

- Don't overlook the need for updates. As your business evolves, so should your Operating Agreement.