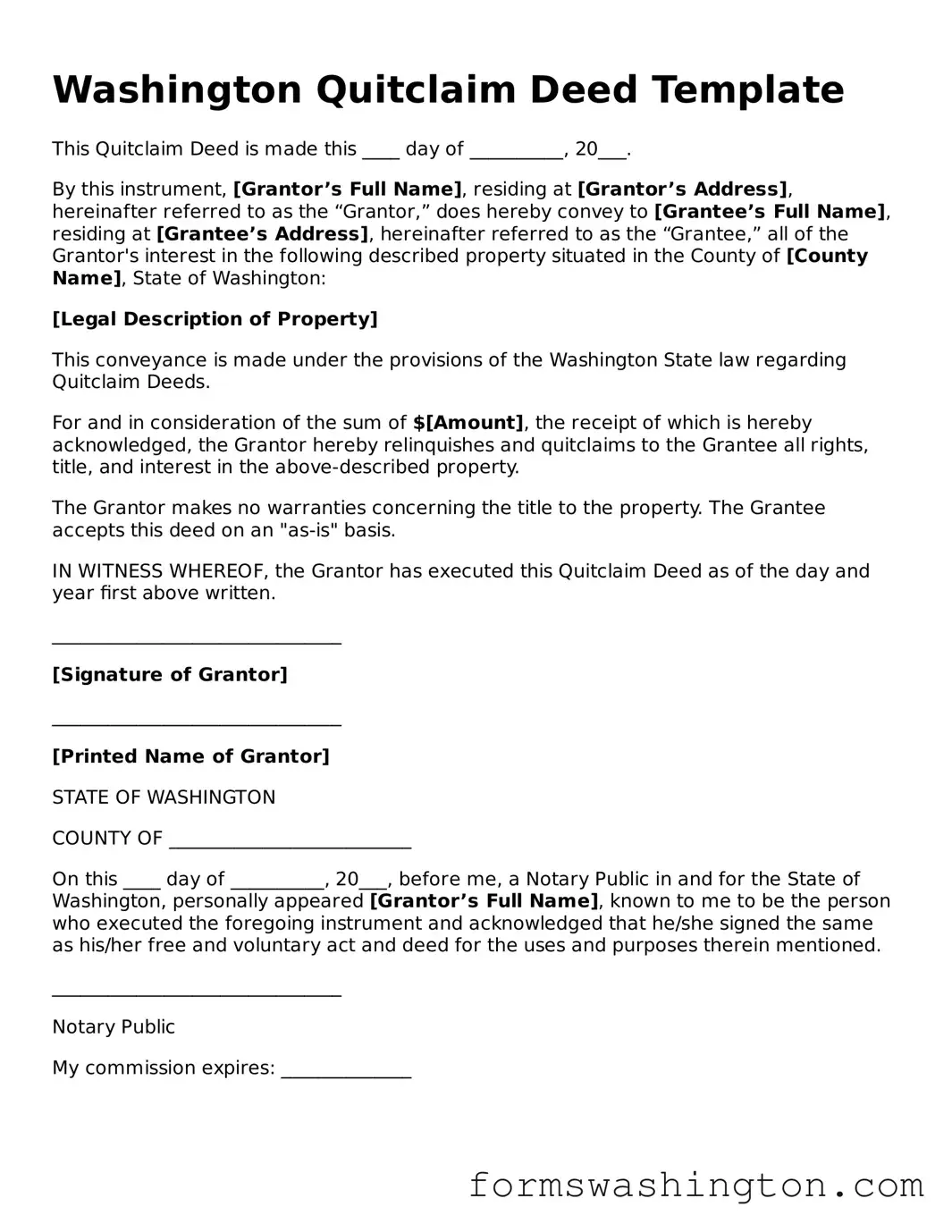

Blank Quitclaim Deed Template for Washington State

The Washington Quitclaim Deed is a vital legal document used in real estate transactions to transfer ownership of property from one party to another. This form is particularly useful when the grantor, or seller, wants to relinquish any claim to the property without making any guarantees about its title. Unlike warranty deeds, which provide assurances regarding the property’s title, a quitclaim deed simply conveys whatever interest the grantor has, if any. This makes it an ideal choice for situations such as transferring property between family members, resolving disputes, or clearing up title issues. The form must be filled out correctly and signed by the grantor, and it is typically recorded with the county auditor to provide public notice of the change in ownership. Understanding the nuances of the Washington Quitclaim Deed is essential for anyone involved in property transfers, as it ensures that the process is smooth and legally sound.

Documents used along the form

The Washington Quitclaim Deed is a vital document used to transfer ownership of property. However, several other forms and documents often accompany it to ensure a smooth and legally sound transaction. Below is a list of commonly used forms that may be needed alongside the Quitclaim Deed.

- Affidavit of Value: This document provides a sworn statement regarding the value of the property being transferred. It helps establish the fair market value for tax purposes.

- Property Transfer Disclosure Statement: Sellers must complete this form to disclose any known issues with the property. This transparency protects both parties and ensures informed decisions.

- Title Insurance Policy: This insurance protects the buyer against any claims or disputes regarding the property’s title. It is crucial for securing the buyer's investment.

- Grant Deed: Similar to a Quitclaim Deed, a Grant Deed transfers property ownership but includes warranties about the title. This adds an extra layer of protection for the buyer.

- Notarized Signature: A notarized signature may be required on the Quitclaim Deed to validate the document. This step ensures that the signatures are authentic and legally binding.

- Property Tax Affidavit: This form confirms that all property taxes have been paid up to the date of the transfer. It helps prevent any future tax liabilities from falling on the new owner.

- Deed of Trust: In some cases, a Deed of Trust may be used to secure a loan against the property. This document creates a lien on the property until the loan is repaid.

- Closing Statement: This document outlines all financial details of the transaction, including costs and fees. It ensures that both parties are clear about the financial aspects of the deal.

Using these documents in conjunction with the Washington Quitclaim Deed can help facilitate a seamless property transfer. Each form plays a specific role in protecting the interests of both the buyer and the seller, ensuring that the transaction is transparent and legally compliant.

Misconceptions

When dealing with the Washington Quitclaim Deed form, several misconceptions often arise. Understanding these can help individuals navigate property transfers more effectively.

- Misconception 1: A Quitclaim Deed guarantees clear title to the property.

- Misconception 2: Quitclaim Deeds are only used between family members.

- Misconception 3: A Quitclaim Deed is the same as a Warranty Deed.

- Misconception 4: Once a Quitclaim Deed is signed, it cannot be revoked.

- Misconception 5: Quitclaim Deeds do not need to be recorded.

- Misconception 6: All states have the same rules regarding Quitclaim Deeds.

- Misconception 7: A Quitclaim Deed can eliminate mortgage obligations.

This is not true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the title is free of liens or other claims.

While often used in family transactions, Quitclaim Deeds can be utilized by anyone transferring property, including in sales or gifts between strangers.

This is incorrect. A Warranty Deed provides a guarantee of title and protection against future claims, while a Quitclaim Deed offers no such assurances.

While a Quitclaim Deed is generally final, it can be challenged in court under certain circumstances, such as fraud or lack of capacity.

Recording the deed is crucial. It protects the grantee's rights and provides public notice of the property transfer.

Each state has its own laws governing Quitclaim Deeds. It's important to understand the specific regulations in Washington.

This is false. A Quitclaim Deed does not remove the original borrower’s responsibility for the mortgage; the lender retains the right to pursue the debt regardless of the deed.

Check out Some Other Templates for Washington

Bill of Sale Washington State - This form is important for legal acknowledgment of ownership changes.

Employee Handbook Washington State - It explains travel and expense reimbursement guidelines.

Washington State Polst Form - A way for individuals to express their values concerning life-sustaining treatments.

Dos and Don'ts

When filling out the Washington Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid.

- Do verify the legal names of all parties involved in the transaction.

- Do include a complete description of the property being transferred.

- Do ensure that the form is signed in the presence of a notary public.

- Do check for any outstanding liens or claims on the property.

- Do file the completed deed with the appropriate county office.

- Don't leave any required fields blank on the form.

- Don't use outdated versions of the Quitclaim Deed form.

- Don't forget to include the date of the transfer.

- Don't use vague or incomplete property descriptions.

- Don't overlook the importance of consulting with a legal professional if needed.