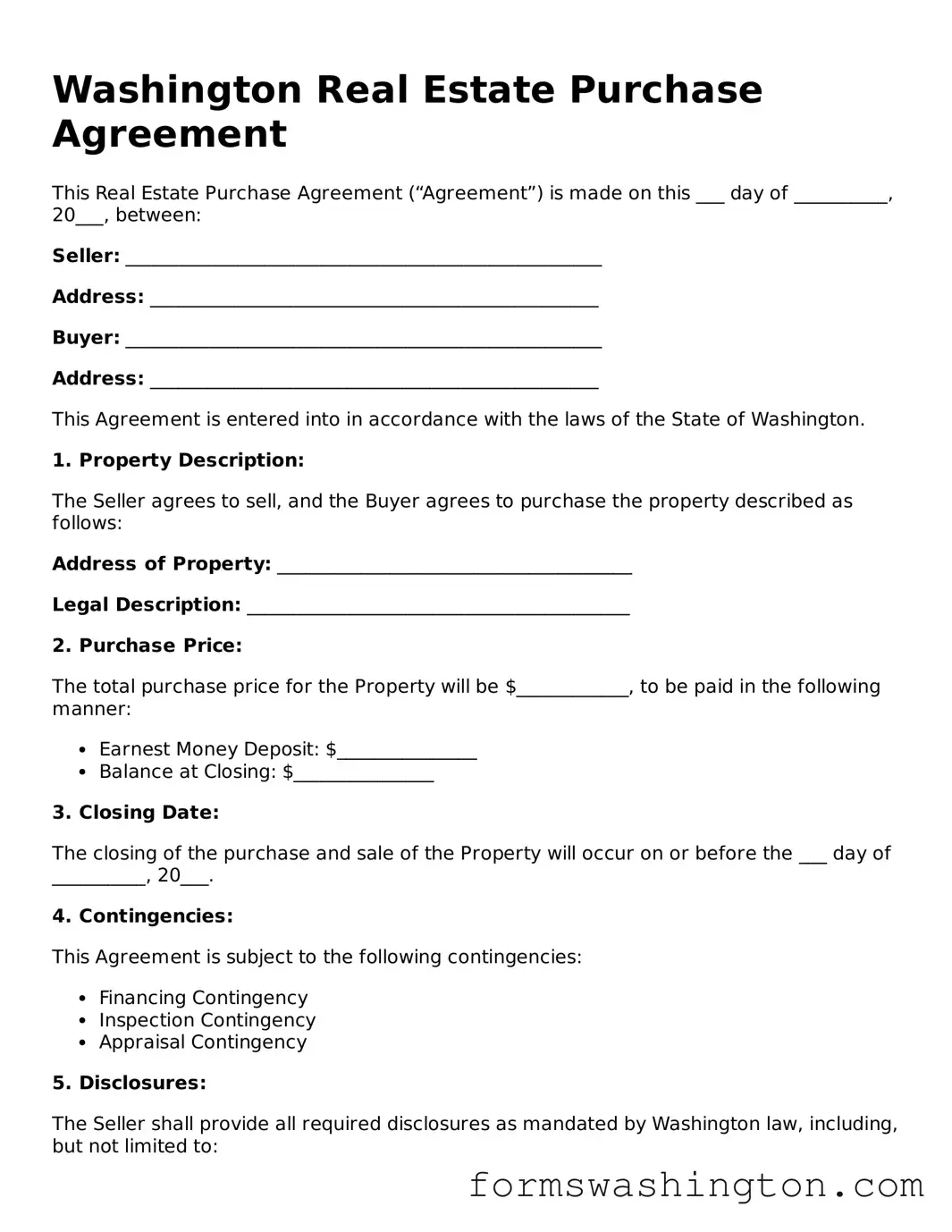

Blank Real Estate Purchase Agreement Template for Washington State

When engaging in a real estate transaction in Washington, the Washington Real Estate Purchase Agreement form serves as a crucial document that outlines the terms and conditions of the sale. This form is designed to protect both the buyer and the seller by clearly defining the rights and responsibilities of each party. It includes essential details such as the purchase price, financing terms, and the closing date, ensuring that all parties are on the same page. Additionally, the agreement addresses contingencies that may affect the sale, such as inspections, appraisals, and the buyer's ability to secure financing. By laying out these terms in a structured manner, the form helps to minimize misunderstandings and disputes, fostering a smoother transaction process. Understanding the components of this agreement is vital for anyone looking to buy or sell property in Washington, as it not only serves as a legal contract but also as a roadmap for the entire real estate transaction.

Documents used along the form

When engaging in a real estate transaction in Washington, several forms and documents accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth process. Here’s a list of commonly used forms that buyers and sellers should be familiar with:

- Seller Disclosure Statement: This document requires the seller to disclose known issues with the property, such as structural problems or pest infestations. It helps buyers make informed decisions.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum outlines the financing terms and conditions. It details the loan type and any contingencies related to financing.

- Inspection Contingency: This document allows the buyer to have the property inspected within a specified time frame. If significant issues arise, the buyer can negotiate repairs or withdraw from the agreement.

- Title Report: A title report provides information about the property’s ownership history and any liens or encumbrances. It ensures that the seller has the right to sell the property.

- Earnest Money Agreement: This agreement outlines the earnest money deposit, which shows the buyer's commitment to the purchase. It specifies how the money will be handled if the deal goes through or falls through.

- Vehicle Purchase Agreement: This essential document formalizes the sale of a vehicle, outlining key details such as the purchase price and responsibilities. For more information, visit topformsonline.com/texas-vehicle-purchase-agreement.

- Closing Disclosure: This document is provided to the buyer three days before closing. It details all closing costs and the final terms of the loan, ensuring transparency in the transaction.

- Deed: The deed transfers ownership of the property from the seller to the buyer. It is a critical document that must be recorded to establish the new owner's legal claim.

Understanding these documents can simplify the real estate process and help both buyers and sellers navigate their transactions more effectively. Each form serves a distinct purpose, and familiarity with them can lead to a smoother experience.

Misconceptions

Understanding the Washington Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property in the state. However, several misconceptions can lead to confusion. Here are six common misunderstandings about this important document:

- The REPA is only for residential properties. Many believe the REPA applies solely to residential real estate transactions. In reality, it can also be used for commercial property transactions, although specific terms may differ.

- Signing the REPA means the sale is final. Some people think that signing the REPA locks them into the sale. However, the agreement typically includes contingencies that allow buyers or sellers to back out under certain conditions.

- The REPA is a one-size-fits-all document. A common misconception is that the REPA is standard and cannot be modified. In fact, parties can negotiate terms and tailor the agreement to fit their specific needs.

- All real estate agents can draft a REPA. Many assume that any real estate agent can prepare a REPA. While agents can facilitate the process, only licensed attorneys can provide legal advice on the document.

- Once submitted, the REPA cannot be changed. Some believe that once the REPA is submitted, it cannot be altered. Amendments can be made if both parties agree to the changes, ensuring flexibility in negotiations.

- Understanding the REPA is unnecessary if you have an agent. Many think they do not need to understand the REPA because they have an agent. However, knowing the key terms and conditions is essential for making informed decisions throughout the transaction.

By addressing these misconceptions, buyers and sellers can navigate the Washington Real Estate Purchase Agreement with greater confidence and clarity.

Check out Some Other Templates for Washington

Washington State Odometer Disclosure - Designate someone you trust to manage your vehicle’s paperwork, ensuring it’s done right.

Utilizing a comprehensive tool such as the Dnd Character Sheet form is essential for Dungeons and Dragons players, as it helps them effectively document their characters’ attributes, including abilities, spells, and gear. For those looking to enhance their gaming experience, resources like smarttemplates.net provide valuable templates that streamline the character creation process.

Washington Trailer Registration - May include the seller's affirmation that they hold clear title to the vehicle being sold.

Whats a Nda Contract - This agreement establishes trust by protecting shared information.

Dos and Don'ts

When filling out the Washington Real Estate Purchase Agreement form, it's important to keep certain best practices in mind. Here’s a helpful list of what to do and what to avoid:

- Do: Read the entire form carefully before filling it out. Understanding each section is crucial.

- Do: Provide accurate information. Double-check names, addresses, and any details regarding the property.

- Do: Consult with a real estate agent or attorney if you have questions. Their expertise can help clarify any uncertainties.

- Do: Keep a copy of the completed agreement for your records. This can be helpful for future reference.

- Don't: Rush through the form. Taking your time can prevent mistakes.

- Don't: Leave any fields blank. If a section doesn’t apply, indicate that clearly.

- Don't: Use vague language. Be specific about terms and conditions to avoid misunderstandings.

- Don't: Forget to sign and date the agreement. An unsigned form is not legally binding.