Blank Small Estate Affidavit Template for Washington State

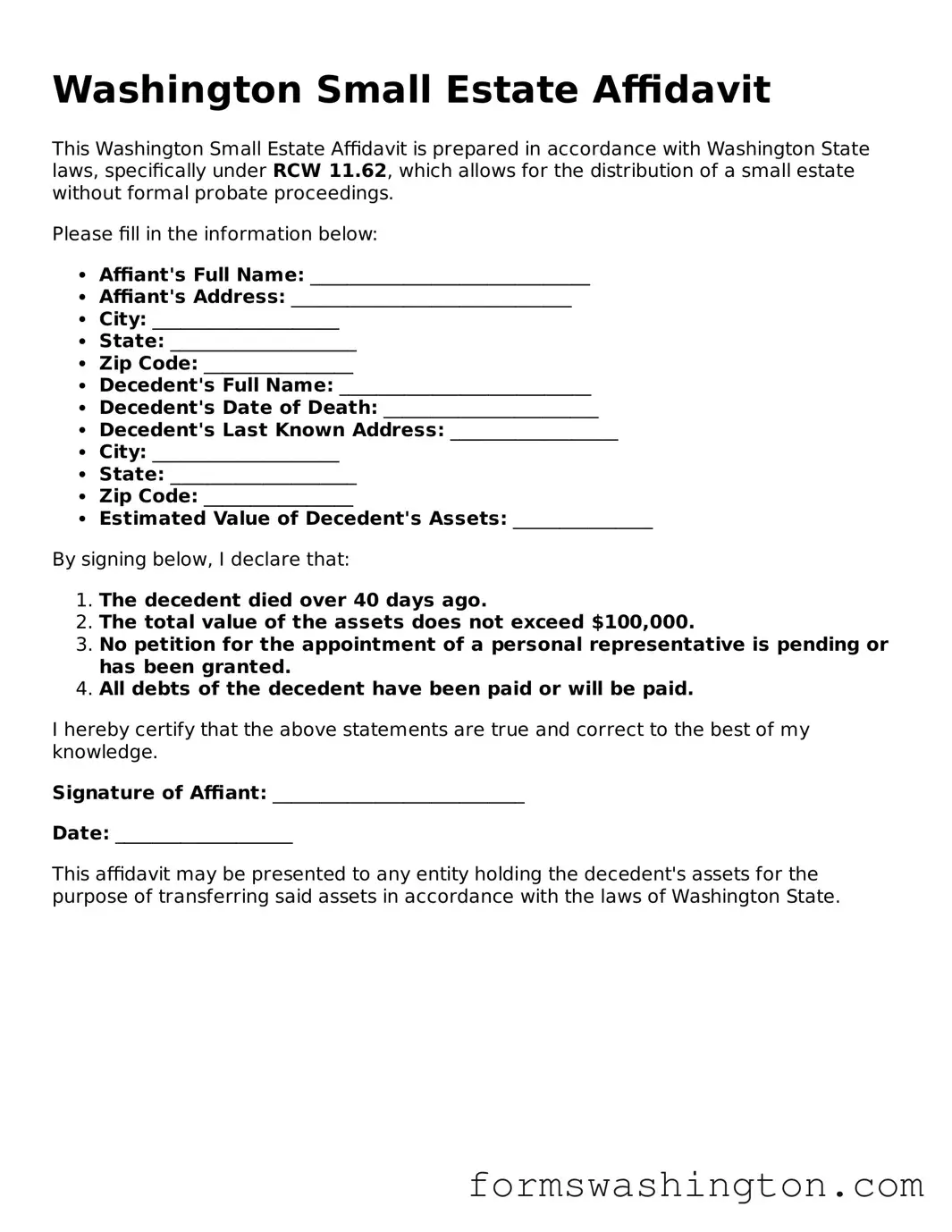

In Washington State, managing the affairs of a deceased loved one can often be a complex and emotional process, particularly when it comes to settling their estate. For those dealing with smaller estates, the Washington Small Estate Affidavit form offers a streamlined approach to transferring assets without the need for formal probate proceedings. This form is specifically designed for estates with a total value of $100,000 or less, excluding certain types of property such as real estate. By utilizing this affidavit, heirs can assert their right to claim the deceased's assets, provided they meet specific eligibility criteria. The process involves completing the affidavit, which requires information about the deceased, details about the assets, and a declaration that the affiant is entitled to the property. Once executed, the affidavit can be presented to financial institutions and other entities holding the deceased's assets, facilitating a quicker resolution and allowing heirs to move forward with their lives. Understanding the requirements and implications of the Small Estate Affidavit is crucial for anyone navigating this sensitive aspect of estate management.

Documents used along the form

When dealing with the Washington Small Estate Affidavit, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose in the administration of a small estate. Below is a list of commonly used forms alongside the Small Estate Affidavit.

- Death Certificate: This official document confirms the death of the individual whose estate is being settled. It is essential for validating claims and initiating the probate process.

- Will: If the deceased left a will, it outlines their wishes regarding the distribution of their assets. It may need to be submitted along with the Small Estate Affidavit.

- Inventory of Assets: This document lists all assets owned by the deceased. It helps in determining the total value of the estate and ensures that all items are accounted for.

- Texas Vehicle Purchase Agreement: To formalize the sale of a vehicle, it's essential to use the topformsonline.com/texas-vehicle-purchase-agreement which outlines the transaction details and the responsibilities of both buyer and seller.

- Affidavit of Heirship: This form may be used to establish the heirs of the deceased when there is no will. It provides a legal declaration of who is entitled to the estate.

- Financial Institution Forms: Banks and financial institutions often require specific forms to release funds or transfer assets. These forms vary by institution.

- Tax Documents: Depending on the estate's value, tax returns may need to be filed. This includes federal and state estate tax returns, if applicable.

- Notice to Creditors: This document informs creditors of the deceased's passing and allows them to make claims against the estate for any debts owed.

- Petition for Probate (if applicable): In some cases, a petition may be necessary to formally open probate proceedings, especially if disputes arise or if the estate exceeds the small estate limit.

Understanding these documents and their purposes can significantly ease the process of settling a small estate in Washington. Proper preparation and organization will help ensure that all necessary steps are taken efficiently.

Misconceptions

The Washington Small Estate Affidavit form is a useful tool for settling the estates of individuals who have passed away. However, several misconceptions exist about its use and requirements. Below are eight common misconceptions:

- Only estates under $100,000 qualify. Many believe that the limit is strictly $100,000. In fact, the limit is $100,000 in personal property, but real estate value is not included in this total.

- All heirs must agree to use the affidavit. It is a misconception that unanimous consent from all heirs is required. Only the person filing the affidavit needs to sign it, although it is advisable to inform other heirs.

- The affidavit can be used for any type of asset. Some people think the affidavit applies to all assets. However, it is primarily for personal property, not real estate or assets held in a trust.

- The process is the same as probate. Many confuse the Small Estate Affidavit process with probate. The affidavit is a simpler, faster alternative to probate, designed for smaller estates.

- Filing the affidavit requires a lawyer. While legal assistance can be helpful, it is not mandatory to have a lawyer to file a Small Estate Affidavit. Individuals can prepare and file it on their own.

- Debts must be paid before filing. Some believe that all debts of the deceased must be settled before using the affidavit. In reality, the affidavit can be filed without settling all debts first.

- The form is the same for every county. There is a misconception that the Small Estate Affidavit form is uniform across Washington State. Each county may have its own version, so it is essential to check local requirements.

- Once filed, the affidavit cannot be changed. Many think that the affidavit is final and cannot be modified. However, if errors are found, corrections can be made by filing an amended affidavit.

Understanding these misconceptions can help individuals navigate the Small Estate Affidavit process more effectively.

Check out Some Other Templates for Washington

Washington State Divorce Papers - Requires both spouses' signatures to validate the agreement.

Using a Dnd Character Sheet form not only simplifies gameplay but also enhances the overall experience by allowing players to keep track of their characters with ease. For those looking for a customizable option, the template available at smarttemplates.net can greatly assist in this process, ensuring that every detail is meticulously recorded to support adventures in the enchanting realms of Dungeons and Dragons.

Washington State Polst Form - A critical part of ensuring dignity in the final stages of life.

Do Snowmobiles Have Titles in Washington State - Useful in documenting financing terms if applicable.

Dos and Don'ts

When filling out the Washington Small Estate Affidavit form, it is essential to approach the process with care. Here are nine important dos and don'ts to consider:

- Do ensure that the total value of the estate does not exceed the limit set by Washington law.

- Do gather all necessary documents, such as the deceased's death certificate and a list of assets.

- Do provide accurate information about the deceased and their assets.

- Do sign the affidavit in front of a notary public.

- Do keep copies of the completed affidavit and all supporting documents for your records.

- Don't underestimate the importance of accuracy; errors can lead to delays.

- Don't include assets that are not part of the estate, such as joint accounts or assets held in a trust.

- Don't forget to check for any debts or liabilities that may affect the estate.

- Don't rush the process; take your time to ensure everything is completed correctly.