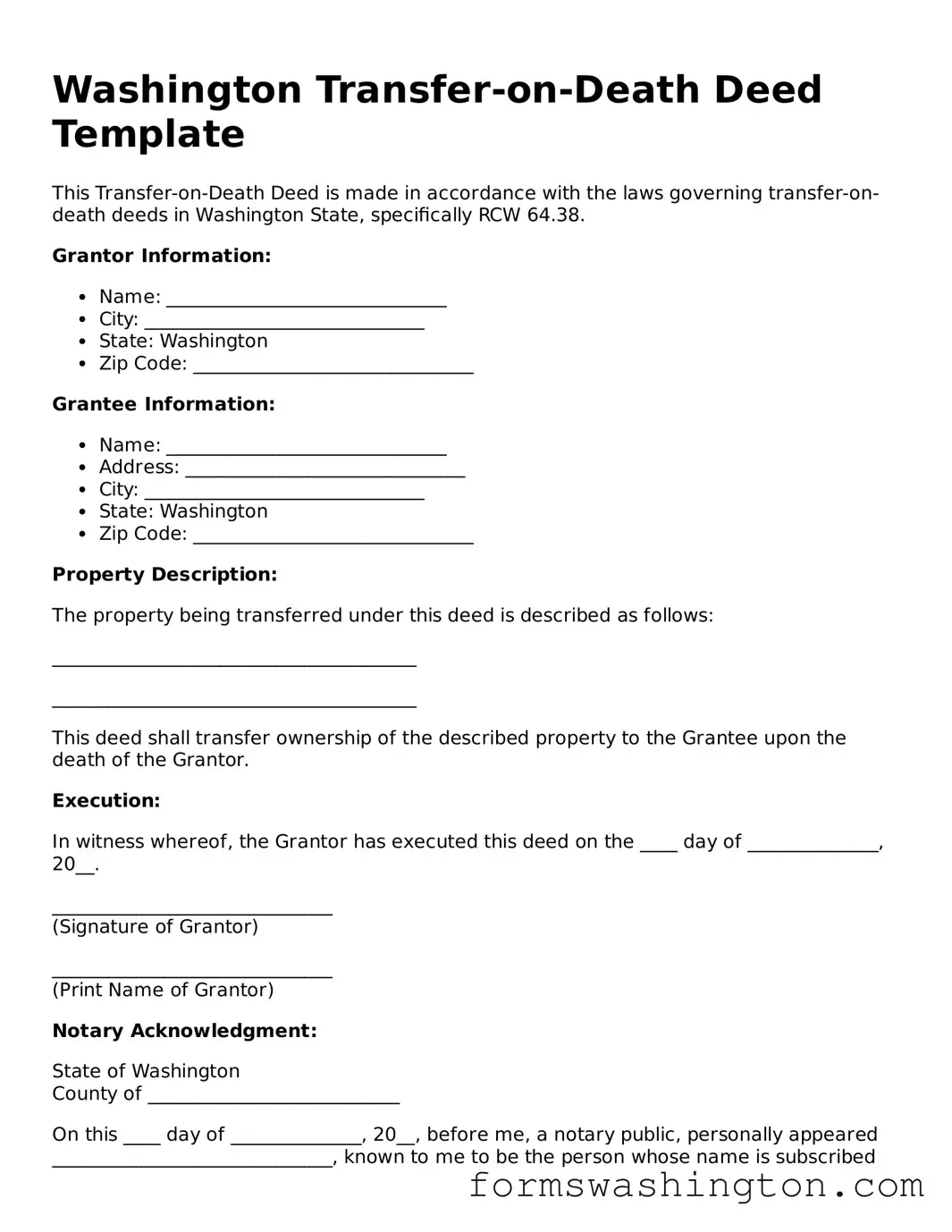

Blank Transfer-on-Death Deed Template for Washington State

The Washington Transfer-on-Death Deed form serves as a valuable tool for individuals looking to streamline the transfer of real property upon their passing. This legal instrument allows property owners to designate beneficiaries who will automatically receive the property without the need for probate. By completing this form, individuals can ensure that their real estate assets are transferred directly to their chosen heirs, thereby simplifying the process and potentially reducing associated costs. The form requires specific information, including the legal description of the property and the names of the beneficiaries, to ensure clarity and prevent disputes. Importantly, the Transfer-on-Death Deed can be revoked or altered at any time before the owner’s death, offering flexibility to adapt to changing circumstances. Additionally, it is essential for property owners to understand the implications of this deed, particularly regarding tax responsibilities and the rights of beneficiaries. Overall, the Washington Transfer-on-Death Deed form represents an efficient approach to estate planning, providing peace of mind for property owners and their loved ones.

Documents used along the form

When considering a Washington Transfer-on-Death Deed, it's essential to understand that this document often works in conjunction with several other forms and documents. Each plays a unique role in ensuring a smooth transfer of property upon death, without the need for probate. Here’s a brief overview of some commonly used documents alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. While a Transfer-on-Death Deed allows for the direct transfer of property, a will can address other assets and specific wishes regarding guardianship and final arrangements.

- Durable Power of Attorney: This legal document grants someone the authority to make decisions on behalf of another person, particularly regarding financial and legal matters. It can be crucial if the property owner becomes incapacitated and needs someone to manage their affairs.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. This document can help avoid probate and ensure that assets are managed according to the grantor's wishes, both during their life and after their death.

- Affidavit of Death: This sworn statement is used to confirm the death of an individual. It can be necessary for various legal processes, including transferring property titles or accessing bank accounts following someone's passing.

- Living Will: To clearly communicate your medical preferences, consider the important Living Will resources that guide you through outlining your healthcare decisions effectively.

- Property Title Transfer Documents: These documents are essential for officially transferring ownership of property from one party to another. After the death of the property owner, these forms help ensure that the new owner is recognized legally.

Understanding these documents can help ensure that your property and wishes are handled according to your desires. Each plays a vital role in the estate planning process, making it easier for loved ones to navigate the complexities of property transfer and inheritance.

Misconceptions

Understanding the Washington Transfer-on-Death Deed form can be challenging, especially with the various misconceptions that surround it. Here are eight common misunderstandings, clarified for better comprehension.

- It automatically transfers property upon signing. Many believe that simply signing the deed means the property is transferred immediately. In reality, the transfer only occurs upon the death of the property owner.

- Only certain types of property can be transferred. Some people think that only residential properties qualify. However, the Transfer-on-Death Deed can apply to various types of real estate, not just homes.

- It eliminates the need for a will. While a Transfer-on-Death Deed can simplify the transfer process, it does not replace the need for a will. A will is still essential for addressing other assets and wishes.

- All heirs are automatically notified. There is a misconception that heirs will be automatically informed about the transfer. In fact, it is the responsibility of the property owner or executor to notify heirs.

- It can be revoked easily without any formalities. Some individuals think they can revoke the deed informally. In Washington, revocation must be done in writing and recorded to be effective.

- It incurs no tax implications. Many assume that using a Transfer-on-Death Deed avoids all tax liabilities. However, estate taxes may still apply depending on the value of the estate.

- It can be used to bypass creditors. A common myth is that this deed allows property to evade creditors. In truth, creditors can still make claims against the property even after the owner's death.

- It is a one-size-fits-all solution. Some people think this deed is suitable for everyone. Each individual's situation is unique, and consulting with a legal professional is recommended to determine the best approach.

By dispelling these misconceptions, individuals can make more informed decisions regarding the use of the Washington Transfer-on-Death Deed form.

Check out Some Other Templates for Washington

How to Write a Bill of Sale for a Gun - A thorough Firearm Bill of Sale helps ensure a smooth and legal transfer of ownership.

Washington Last Will and Testament - It can provide detailed instructions on how the deceased would like their estate managed.

The completion of the Texas RV Bill of Sale is crucial for anyone looking to buy or sell a recreational vehicle in Texas, as it not only validates the transaction but also ensures that the rights of both parties are upheld. For more detailed information on how to properly execute this document, you can refer to https://topformsonline.com/texas-rv-bill-of-sale, which provides valuable insights and guidance.

2024 Labor Laws - The agreement can specify the types of activities considered competitive to clarify expectations.

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do ensure that you understand the purpose of the Transfer-on-Death Deed.

- Do accurately fill in the names of all parties involved, including the property owner and beneficiaries.

- Do provide a clear legal description of the property being transferred.

- Do sign the deed in front of a notary public.

- Do record the deed with the county auditor’s office to make it effective.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Don't use vague language when describing the property.

- Don't forget to inform your beneficiaries about the deed and its implications.

- Don't attempt to make changes to the deed after it has been signed and recorded without following proper procedures.