Washington 27 0054 Form

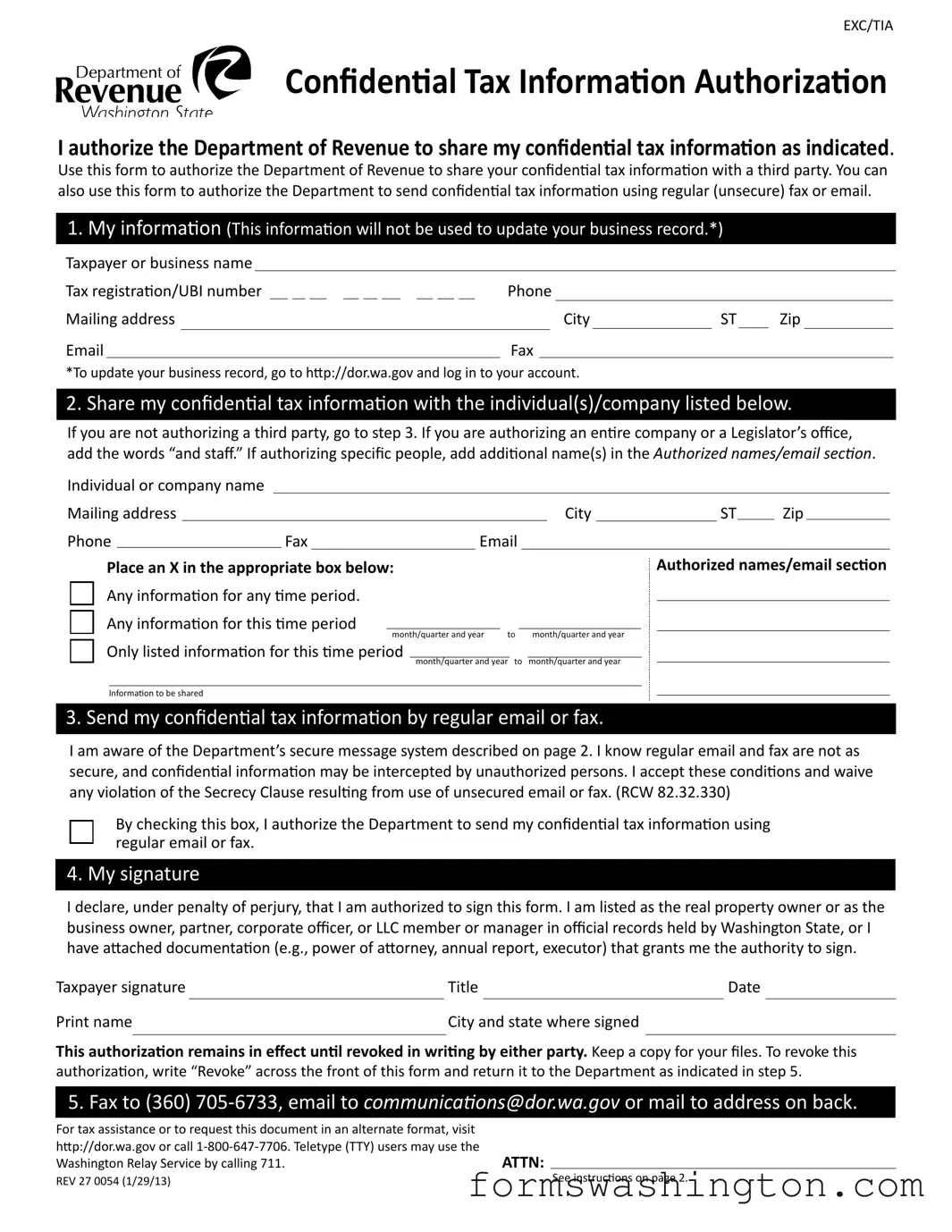

The Washington 27 0054 form, officially known as the Authorization for Confidential Tax Information, plays a crucial role for taxpayers in Washington State who wish to share their confidential tax information with third parties. This form allows individuals and businesses to authorize the Department of Revenue to disclose their tax details, which can include sensitive financial data. By completing this form, taxpayers can specify the information they want to be shared, as well as the time period for which this authorization is valid. It is important to note that the form offers options for sharing information securely or through less secure methods like regular email or fax, with a clear acknowledgment of the associated risks. Taxpayers must provide their personal information, including their business name and contact details, and they have the option to authorize specific individuals or entire companies. The form also requires a signature to confirm that the signer is authorized to make such requests, ensuring that only legitimate parties can access sensitive information. Overall, understanding how to properly fill out and submit the Washington 27 0054 form is essential for anyone looking to manage their tax information effectively while maintaining compliance with state regulations.

Documents used along the form

The Washington 27 0054 form is essential for authorizing the Department of Revenue to share confidential tax information. However, several other forms and documents are commonly used in conjunction with this form. Each serves a specific purpose and can help streamline the process of managing tax-related matters.

- Power of Attorney (POA): This document allows an individual to appoint someone else to act on their behalf in tax matters. It is often required to grant authority to a tax professional or advisor.

- Tax Registration Application: This form is used to register a new business with the Department of Revenue. It includes essential details such as the business name, address, and type of business.

- Annual Tax Return: Businesses must file this document yearly to report their income and expenses. It helps determine the amount of tax owed or any refund due.

- Request for Taxpayer Identification Number: This form is used to apply for an Employer Identification Number (EIN) or a Washington State UBI number, which is essential for tax purposes.

- Texas RV Bill of Sale: This document is crucial for recording the sale of a recreational vehicle in Texas, providing proof of ownership transfer and ensuring a secure transaction. For detailed information, visit https://topformsonline.com/texas-rv-bill-of-sale.

- Tax Exemption Certificate: This document is used by businesses to claim exemption from sales tax on certain purchases. It must be presented to suppliers when making tax-exempt purchases.

- Tax Clearance Certificate: This certificate verifies that a business has no outstanding tax obligations. It may be required for various business transactions, such as selling a business or applying for loans.

- Change of Address Form: This form is used to notify the Department of Revenue about a change in the business's mailing address. Keeping this information current is crucial for receiving important tax documents.

- Monthly/Quarterly Tax Reporting Form: Depending on the business's tax obligations, this form is used to report sales and use tax collected during a specific period.

- Taxpayer Account Update Form: This form is used to update any changes to the business's account information, such as ownership changes or business structure modifications.

Understanding these documents can significantly aid in navigating the tax landscape in Washington. Each form plays a vital role in ensuring compliance and managing tax responsibilities effectively.

Misconceptions

Understanding the Washington 27 0054 form can be challenging due to common misconceptions. Here are six of them:

- Misconception 1: The form can be used to update business information.

- Misconception 2: You must authorize a specific individual to receive your tax information.

- Misconception 3: The form is only for secure communication.

- Misconception 4: You can revoke the authorization at any time without following a process.

- Misconception 5: You don’t need to keep a copy of the form.

- Misconception 6: The form is only for individuals.

This is not true. The Washington 27 0054 form is specifically for authorizing the sharing of confidential tax information, not for updating business records. To update your business information, you must log in to your account on the Department of Revenue's website.

This is misleading. While you can authorize specific individuals, you can also authorize an entire company or a legislator's office. Simply add "and staff" to your authorization if you want to include everyone in that organization.

This is incorrect. The form allows for both secure and unsecured communication. You have the option to receive your information via regular email or fax, but you should be aware that these methods are less secure.

This is not the case. To revoke your authorization, you must write "Revoke" on the front of the form and return it to the Department of Revenue. This ensures that your request is properly processed.

This is a mistake. It is important to keep a copy of the form for your records. This will help you verify your authorization and provide proof if needed in the future.

This is misleading. The Washington 27 0054 form can be used by businesses as well. Any authorized person, such as a business owner or corporate officer, can complete the form on behalf of the business.

Find Common PDFs

Washington Liq 318 - Late reports incur a penalty of 2% per month, a deterrent against delays.

For those navigating the complexities of vehicle ownership transfer in California, understanding the California REG 262 form is essential. This form, also referred to as the Vehicle/Vessel Transfer and Reassignment Form, is designed to streamline various processes such as the bill of sale, odometer disclosure, and even power of attorney. To ensure compliance and proper documentation, it is crucial to complete this form in ink and submit it alongside the title or a duplicate title application. For more detailed information regarding this form, you can visit OnlineLawDocs.com.

Parenting Plan Forms Washington State - Access to support documents, like financial worksheets, is facilitated through this resource.

Dos and Don'ts

When filling out the Washington 27 0054 form, consider the following guidelines:

- Do provide accurate information in all required fields.

- Do double-check the mailing address and contact information for accuracy.

- Do specify the time period for which you want to share tax information.

- Do keep a copy of the completed form for your records.

- Do use secure methods for sending sensitive information when possible.

- Don't leave any required fields blank.

- Don't forget to sign and date the form before submission.

- Don't use unsecured email or fax without understanding the risks involved.

- Don't authorize sharing information with individuals or companies not listed on the form.

- Don't submit the form without reviewing the instructions thoroughly.