Washington 5 Form

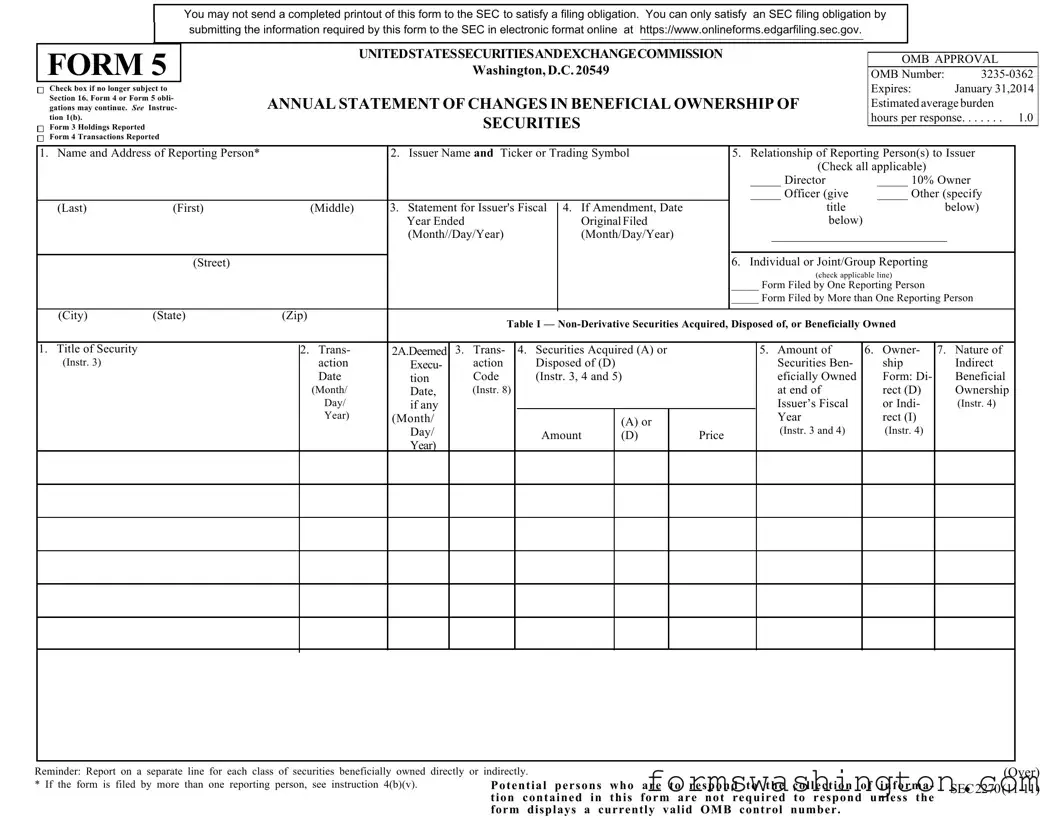

The Washington 5 form serves as a crucial tool for reporting changes in beneficial ownership of securities, ensuring transparency and compliance with federal regulations. Designed for use by individuals with specific relationships to a company—such as directors, officers, or significant shareholders—this form captures vital information regarding both non-derivative and derivative securities. It requires details like the names and addresses of reporting persons, the issuer’s name and ticker symbol, and the fiscal year-end date. Additionally, the form differentiates between securities acquired or disposed of, and it mandates that all transactions be reported accurately to maintain the integrity of the financial markets. Importantly, this form must be submitted electronically through the SEC’s designated online platform, emphasizing the shift toward digital compliance. Notably, individuals may check a box indicating they are no longer subject to Section 16 obligations, which can streamline the reporting process. With clear instructions and structured tables, the Washington 5 form aims to facilitate straightforward reporting while reinforcing the accountability of those who hold significant positions in publicly traded companies.

Documents used along the form

When dealing with securities and ownership disclosures, several forms and documents complement the Washington 5 form. Understanding these documents can help ensure compliance with regulatory requirements and facilitate transparent reporting.

- Form 3: This form is used to report the initial ownership of securities by an individual who is subject to Section 16 of the Securities Exchange Act. It provides a snapshot of the securities held at the time the individual becomes a reporting person.

- Form 4: This document is filed to report changes in ownership of securities by insiders. It must be submitted within two business days of the transaction, ensuring timely disclosure of buying or selling activities.

- Form 10-K: This is an annual report that provides a comprehensive overview of a company's financial performance. It includes audited financial statements, management's discussion, and analysis, as well as information about the company's operations.

- Form 10-Q: A quarterly report that updates shareholders on a company’s financial status. It includes unaudited financial statements and provides insights into the company's performance for the quarter.

- Proxy Statement (Form DEF 14A): This document is filed in advance of a shareholder meeting. It provides essential information about matters to be voted on, including details about directors, executive compensation, and other important issues.

- Loan Agreement: For those seeking to finance their projects, our complete Florida Loan Agreement form guidelines provide essential details for securing your loan legally.

- Form S-1: This registration statement is used by companies planning to go public. It includes details about the company's business, financials, and the offering itself, allowing potential investors to make informed decisions.

- Schedule 13D: This form is required when a person or group acquires more than 5% of a company's shares. It provides information about the acquirer’s intentions and plans regarding the company.

- Schedule 13G: Similar to Schedule 13D, this form is filed by passive investors who acquire more than 5% of a company's shares but do not intend to influence control of the company.

- Form 8-K: This form is used to report significant events that may be of interest to shareholders. It ensures that investors receive timely information about important developments affecting the company.

Each of these forms plays a vital role in the landscape of securities regulation. They help maintain transparency and protect investors by ensuring that all relevant information is disclosed in a timely manner. Staying informed about these documents can empower individuals and companies to navigate the regulatory environment more effectively.

Misconceptions

Misconceptions about the Washington 5 form can lead to confusion and potential compliance issues. Here are five common misunderstandings:

- It must be submitted in paper form. Many believe that the Washington 5 form must be printed and mailed. In fact, it can only be submitted electronically through the SEC’s online portal.

- All sections of the form are mandatory. Some individuals think every section must be filled out. However, only the relevant sections apply to your specific reporting situation. Review the instructions carefully to determine what is necessary.

- Filing is optional if you are no longer subject to Section 16. A common misconception is that if someone is no longer subject to Section 16, they do not need to file at all. While you can check the box indicating you are no longer subject, other obligations may still apply.

- It is acceptable to submit the form without a valid OMB control number. Some assume that they can file without this number. However, if the form does not display a currently valid OMB control number, you are not required to respond.

- Amendments can be filed without following specific guidelines. There is a belief that amendments can be made freely. In reality, amendments must follow the specific procedures outlined in the instructions to ensure compliance.

Understanding these misconceptions is crucial for accurate reporting and compliance with SEC regulations. Make sure to review the form and its requirements thoroughly.

Find Common PDFs

Washington State Real Estate Excise Tax - Transaction details in the form are used for public records and statistics.

When navigating the complexities of property transfers, understanding a Quitclaim Deed form for family property transfers can be invaluable. This document facilitates the swift exchange of interest, making it ideal for situations like inheritance or divorce settlements.

Insideewu - Information provided on the form is protected under privacy laws, ensuring confidentiality.

Dos and Don'ts

When filling out the Washington 5 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do check that the form displays a valid OMB control number before proceeding.

- Do submit the form electronically through the SEC’s designated website.

- Do report each class of securities on a separate line as required.

- Do ensure all required fields are filled out completely and accurately.

- Don't send a completed printout of the form to the SEC.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't provide misleading information or omit necessary details.

- Don't forget to sign the form if it requires a manual signature.