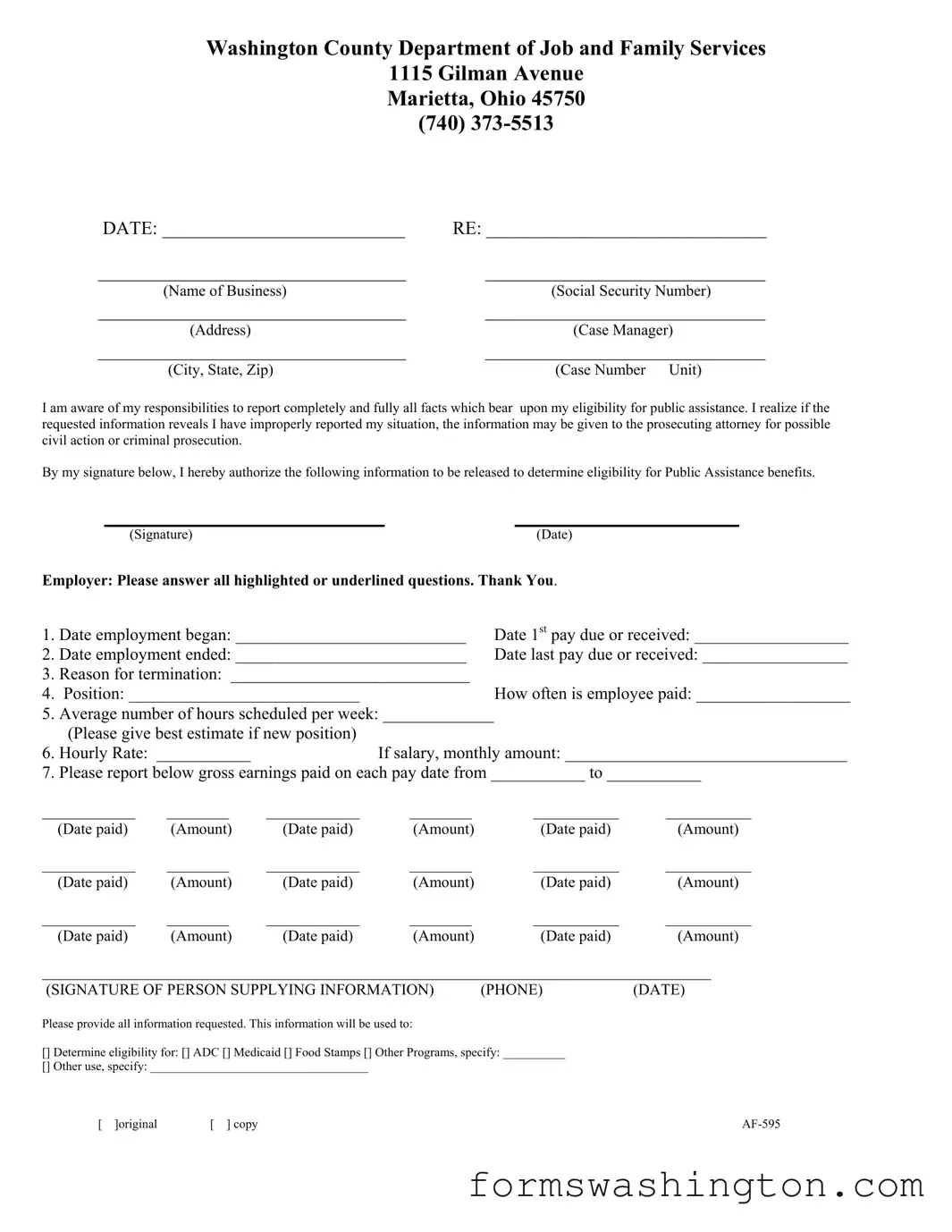

Washington Af 595 Form

The Washington AF 595 form is an essential document utilized by the Washington County Department of Job and Family Services to assess an individual's eligibility for public assistance benefits. This form requires detailed information about employment history, including the dates of employment, reasons for termination, and gross earnings over specified pay periods. It serves as a tool for both applicants and employers, ensuring that all necessary information is reported accurately and comprehensively. Individuals filling out the form must acknowledge their responsibility to provide truthful information, as any discrepancies may lead to legal consequences. The document also includes sections for employers to complete, highlighting key employment details that contribute to the eligibility determination process. By collecting this information, the AF 595 form plays a crucial role in facilitating access to vital assistance programs such as Aid to Dependent Children (ADC), Medicaid, and Food Stamps, among others.

Documents used along the form

The Washington AF 595 form is often used in conjunction with several other documents to facilitate the determination of eligibility for public assistance benefits. Below is a list of commonly associated forms and documents that may be required during the application process.

- Application for Benefits (JFS 7200): This form is used to apply for various public assistance programs, including food assistance and Medicaid. It collects personal information, income details, and household composition.

- Verification of Employment (JFS 7300): Employers complete this document to verify an applicant's employment status, including job title, wages, and hours worked. It supports the information provided in the AF 595 form.

- Income Verification Form (JFS 7400): This form requests detailed income information from applicants. It helps determine eligibility by documenting all sources of income.

- Client Rights and Responsibilities (JFS 7100): This document outlines the rights and responsibilities of individuals applying for public assistance. It ensures applicants understand their obligations and the services available to them.

- Authorization for Release of Information (JFS 7500): Applicants use this form to authorize the sharing of their personal information with relevant agencies. It is essential for verifying eligibility and processing applications.

- Food Assistance Program (FAP) Application (JFS 7201): Specifically for food assistance, this application gathers information about household size, income, and expenses to assess eligibility.

- Medicaid Application (JFS 7202): This form is specifically designed for individuals seeking Medicaid benefits. It collects health-related information and financial details necessary for eligibility assessment.

- Child Support Information Form (JFS 7401): This document is used to provide information regarding child support payments, which can affect eligibility for certain assistance programs.

- Proof of Residency Form (JFS 7600): Applicants must provide proof of residency to confirm their eligibility for local assistance programs. This form may require utility bills or lease agreements.

These documents collectively assist in the eligibility determination process for public assistance programs in Washington County. Ensuring accurate and complete information across all forms is crucial for a smooth application experience.

Misconceptions

Understanding the Washington AF 595 form is crucial for anyone involved in public assistance programs. However, several misconceptions can lead to confusion. Here are six common misconceptions explained:

- Misconception 1: The form is only for new applicants.

- Misconception 2: Completing the form is optional.

- Misconception 3: Only employers need to fill out the form.

- Misconception 4: The information provided is kept confidential.

- Misconception 5: The form is straightforward and requires minimal detail.

- Misconception 6: Submitting the form guarantees approval for benefits.

This is not true. The Washington AF 595 form is used for both new applicants and current beneficiaries who need to report changes in their circumstances.

In reality, completing the form is mandatory for those seeking or receiving public assistance. Failing to provide accurate information can lead to serious consequences.

While employers provide essential information, individuals applying for assistance must also complete sections of the form to ensure their eligibility is accurately assessed.

Although efforts are made to protect your privacy, certain information may be shared with legal authorities if there are indications of fraud or misrepresentation.

On the contrary, the form requires comprehensive details about employment history, earnings, and other relevant factors. Incomplete information can delay the processing of your application.

Submitting the Washington AF 595 form does not guarantee that benefits will be granted. Eligibility is determined based on a variety of factors, including the accuracy and completeness of the information provided.

Find Common PDFs

Washington 4 H Record Book - Helps establish a connection between learning, doing, and reflecting on your projects.

Art Institute Closed - Direct your transcript to the designated recipient using the appropriate section.

Pact Nail Treatment - Each PACT team can determine the best approach to implement the comprehensive assessment.

Dos and Don'ts

When filling out the Washington Af 595 form, keep the following tips in mind to ensure a smooth process:

- Do read the entire form carefully before starting. Understanding what is required will save you time and effort.

- Do provide accurate information. Double-check your entries to avoid mistakes that could delay your application.

- Do sign and date the form at the bottom. An unsigned form may be considered incomplete.

- Don't leave any highlighted or underlined questions unanswered. These are crucial for your eligibility assessment.

- Don't rush through the process. Take your time to ensure all details are correct and complete.

- Don't hesitate to ask for help if you're unsure about any part of the form. It's better to seek clarification than to submit incorrect information.