Washington Liq 318 Form

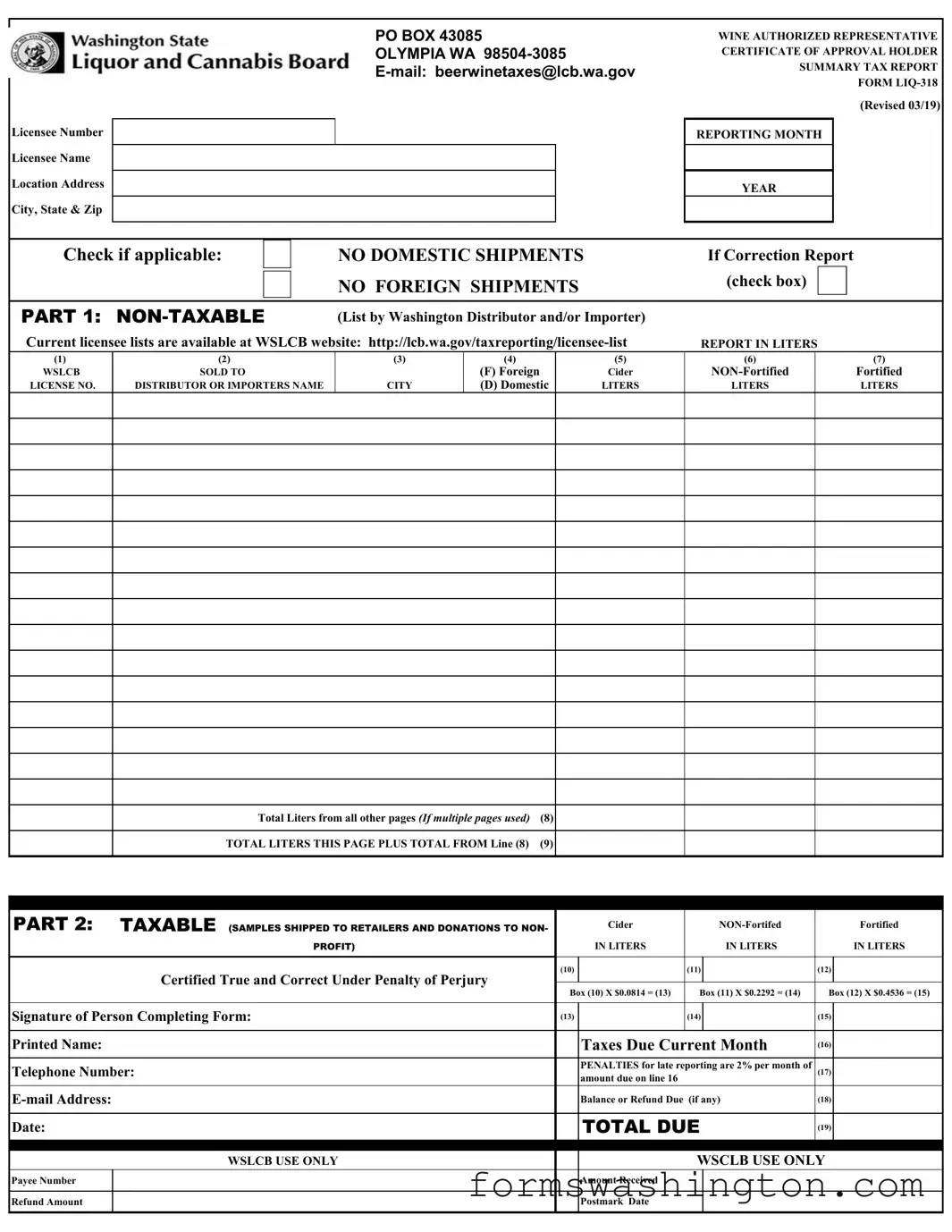

The Washington Liq 318 form is an essential tool for businesses involved in the wine industry within the state. This monthly report is required for all Wine Authorized Representative Certificate of Approval Holders, ensuring compliance with state tax regulations. Each licensee must submit their report by the 20th of the month following the reporting period, even if there were no shipments during that time. The form includes sections for both non-taxable and taxable shipments, allowing licensees to detail their wine distributions to various distributors and retailers. It also provides specific guidelines for reporting, including the necessity of listing shipments in liters and the calculation of taxes due based on the type of wine shipped. Additionally, the form addresses penalties for late submissions, emphasizing the importance of timely and accurate reporting. Overall, the Liq 318 form plays a critical role in maintaining transparency and accountability in Washington's wine market.

Documents used along the form

When dealing with the Washington Liq 318 form, several other documents may also be required to ensure compliance with state regulations regarding wine distribution and taxation. Understanding these forms can help streamline the reporting process and maintain accurate records.

- Form LIQ-778: This form is used for reporting direct shipments to Washington consumers or retailers. It is essential for businesses that wish to ship wine directly to customers within the state. This form ensures compliance with state laws regarding direct sales and helps track shipments accurately.

- Form LIQ-310: The Application for a Certificate of Approval is necessary for businesses looking to import or distribute wine in Washington. This document provides the state with essential information about the business and its operations, allowing for proper licensing and regulation.

- DA Form 31: This form is essential for U.S. Army personnel seeking to request leave, providing a structured approach necessary for compliance within military regulations. For additional details, visit smarttemplates.net.

- Form LIQ-320: The Monthly Report of Sales form is required for all wine distributors and importers. This form details the sales made during the month and is crucial for calculating the taxes owed to the state. Timely submission helps avoid penalties and ensures compliance with state regulations.

- Form LIQ-330: This form is used for reporting any changes to a business's license status, such as changes in ownership or location. Keeping this information updated is vital for maintaining compliance with the Washington State Liquor and Cannabis Board's regulations.

By familiarizing yourself with these forms, you can navigate the regulatory landscape more effectively. Each document plays a crucial role in ensuring compliance and facilitating smooth operations within the wine distribution industry in Washington State.

Misconceptions

Misconception 1: The LIQ-318 form is only for reporting taxable shipments.

This is not true. The LIQ-318 form must be completed for both taxable and non-taxable shipments. It is essential to report all shipments, regardless of their tax status, to ensure compliance with state regulations.

Misconception 2: You only need to file the LIQ-318 form if you have shipments.

Even if there are no shipments for a given month, a report must still be filed. It is crucial to check the box indicating no shipments to avoid penalties.

Misconception 3: The form can be submitted any time before the deadline.

The LIQ-318 form must be postmarked by the 20th of the month following the reporting month. If the 20th falls on a weekend or holiday, it should be sent by the next postal business day.

Misconception 4: You can report sales delivered to military installations.

Sales delivered to military installations, commercial carriers, or ship chandlers should not be reported on the LIQ-318 form. This is a specific requirement that must be followed.

Misconception 5: Only the licensee can complete the form.

While the licensee must sign the form, it can be completed by an authorized representative. This flexibility allows for easier management of reporting duties.

Misconception 6: The penalties for late reporting are minimal.

Penalties for late reporting accumulate at a rate of 2% per month of the amount due. This can add up quickly, making timely submission essential to avoid significant costs.

Find Common PDFs

Custody Paperwork Washington State - The form’s requirements are subject to change; always refer to the latest guidelines.

Understanding the significance of a Living Will is crucial for making informed healthcare decisions; this important document allows individuals to specify their treatment preferences when they cannot express their wishes. For more information, explore the guide on how a Living Will can protect your healthcare rights by visiting our Living Will resource.

Art Institute Closed - Ensure all details are correct to avoid processing delays.

Dos and Don'ts

When filling out the Washington Liq 318 form, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below is a list of recommended actions and pitfalls to avoid.

- Do enter your 6-digit Washington State Liquor and Cannabis Board license number accurately.

- Do report all shipments for the month, regardless of the invoice date.

- Do check the appropriate box if there are no shipments for the month.

- Do round all figures to two decimal places when reporting liters.

- Do ensure that the form is postmarked by the 20th of the following month.

- Don't duplicate reporting of the same product on other forms.

- Don't report sales delivered to military installations, commercial carriers, or ships chandlers.