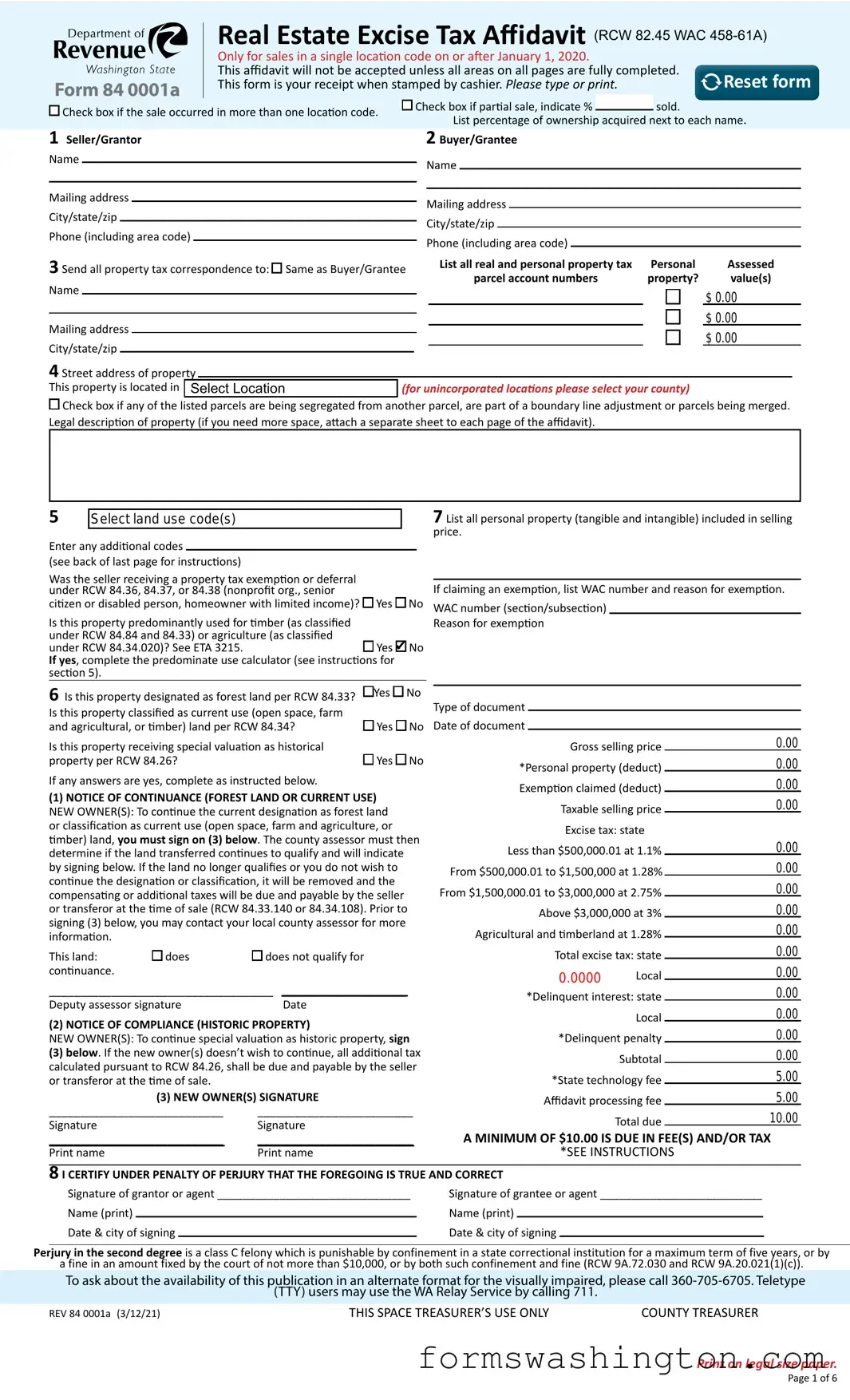

Washington Real Estate Excise Tax Affidavit Form

The Washington Real Estate Excise Tax Affidavit form is a crucial document in the real estate transaction process, particularly for those buying or selling property within the state. This form serves multiple purposes, including the declaration of the sale price, the identification of the parties involved, and the reporting of any exemptions that may apply to the transaction. By accurately completing this affidavit, parties can ensure compliance with state tax laws and facilitate the proper assessment of the excise tax owed. The form requires detailed information about the property, such as its legal description and the type of transaction taking place, whether it’s a sale, transfer, or other disposition. Additionally, it must be filed with the county auditor at the time of recording the deed, making it an essential step in the closing process. Understanding the nuances of this affidavit can help both buyers and sellers navigate their responsibilities and avoid potential pitfalls associated with real estate transactions in Washington.

Documents used along the form

When engaging in real estate transactions in Washington State, the Real Estate Excise Tax Affidavit is an essential document. However, it is often accompanied by several other forms and documents that help facilitate the process and ensure compliance with local regulations. Below is a list of these commonly used documents, each serving a specific purpose in the transaction.

- Purchase and Sale Agreement: This is the primary contract between the buyer and seller that outlines the terms of the sale, including the purchase price, contingencies, and closing date.

- Title Insurance Policy: This document protects the buyer and lender against potential defects in the title, ensuring that the property is free of liens or other encumbrances.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded with the county.

- Closing Disclosure: This form provides a detailed account of all closing costs and fees associated with the transaction. It is given to the buyer at least three days before closing.

- Property Disclosure Statement: Sellers are required to disclose known defects or issues with the property. This statement helps buyers make informed decisions.

- Affidavit of Value: This document is often used to provide a sworn statement of the property's value, which can be necessary for tax assessments.

- Dnd Character Sheet: The smarttemplates.net provides access to a fillable character sheet, allowing players to efficiently manage important character details while playing Dungeons and Dragons.

- Escrow Agreement: This agreement outlines the terms under which an escrow agent holds funds and documents until the transaction is complete.

- Loan Documents: If the buyer is financing the purchase, various loan documents will be required, including the mortgage agreement and promissory note.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS. It is often required for tax purposes by the seller.

Each of these documents plays a crucial role in ensuring that the real estate transaction is conducted smoothly and legally. Understanding their purpose can help both buyers and sellers navigate the complexities of property transfers in Washington State.

Misconceptions

The Washington Real Estate Excise Tax Affidavit form is often misunderstood. Here are nine common misconceptions about this important document:

-

It only applies to residential property transactions.

Many believe the form is exclusive to residential properties. In reality, it applies to all real estate transactions, including commercial and industrial properties.

-

Filing the form is optional.

Some people think they can skip filing the affidavit. However, it is a mandatory requirement for recording the sale of real estate in Washington.

-

The tax is based solely on the sale price.

While the sale price is a key factor, other considerations, such as the property's value and any improvements made, can also influence the tax amount.

-

Only the buyer is responsible for filing the affidavit.

Both the buyer and seller have responsibilities regarding the form. It is crucial for both parties to ensure it is completed and submitted correctly.

-

The form is the same for all counties in Washington.

Each county may have specific requirements or variations in the form. It's important to check with local authorities to ensure compliance.

-

Filing the form guarantees a smooth transaction.

While filing is necessary, it does not automatically ensure that there will be no issues during the transaction. Other factors, such as title issues, can still arise.

-

The tax rate is fixed and does not change.

Tax rates can vary based on local jurisdictions and may change over time. It's essential to verify the current rate before completing the form.

-

Once filed, the affidavit cannot be amended.

In fact, if errors are found, amendments can be made. It’s important to address any mistakes promptly to avoid complications.

-

There are no penalties for late filing.

Failure to file the affidavit on time can lead to penalties and interest. Timely submission is crucial to avoid additional costs.

Understanding these misconceptions can help ensure a smoother real estate transaction process in Washington.

Find Common PDFs

Pact Nail Treatment - Psychiatric history is a crucial element of the assessment process.

When seeking to navigate the complexities of borrowing, utilizing a formal Loan Agreement is crucial to ensure an understanding between all parties involved. For a more structured approach to your financial arrangements, you can explore our guide on the Loan Agreement process by visiting the detailed Loan Agreement steps.

Washington Liq 318 - The form reflects the commitment of wine representatives to legal responsibilities.

Dos and Don'ts

When filling out the Washington Real Estate Excise Tax Affidavit form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are seven things to do and not do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the property being sold.

- Do include all necessary signatures where required.

- Do double-check calculations to avoid errors in tax amounts.

- Don't leave any sections blank; fill in all required fields.

- Don't use abbreviations that could cause confusion.

- Don't submit the form without reviewing it for completeness.